Co-founder Kevin Zhou says that the locked funds are worth about $40 million.

Galois Capital, a cryptocurrency hedge fund, told CoinDesk in a Telegram message on Saturday that about half of its funds are stuck on FTX, a troubled cryptocurrency exchange that filed for chapter 11 bankruptcy on Friday.

Zhou said that the funds locked up in FTX are worth about $40 million.

Galois was praised earlier this year for being able to predict the crash of Terra, the stablecoin ecosystem whose $60 billion loss was one of the main reasons why cryptocurrencies fell into the current bear market.

Depending on how the bankruptcy case goes, Galois and other FTX investors may not be able to get their money back for a while.

In a letter to Galois investors, Zhou said that the company might not get back “some percentage” of its funds for “a few years.” He told investors, “We will work hard to improve our chances of getting stuck capital back by any means.”

Until recently, FTX was the second-largest cryptocurrency exchange by volume, and sophisticated investors and institutional clients trusted it more than other platforms.

Things started to go wrong for FTX when CoinDesk found leaked documents that showed the company’s sister company, Alameda Research, was using illiquid tokens, including FTX’s own FTT token, as collateral for loans.

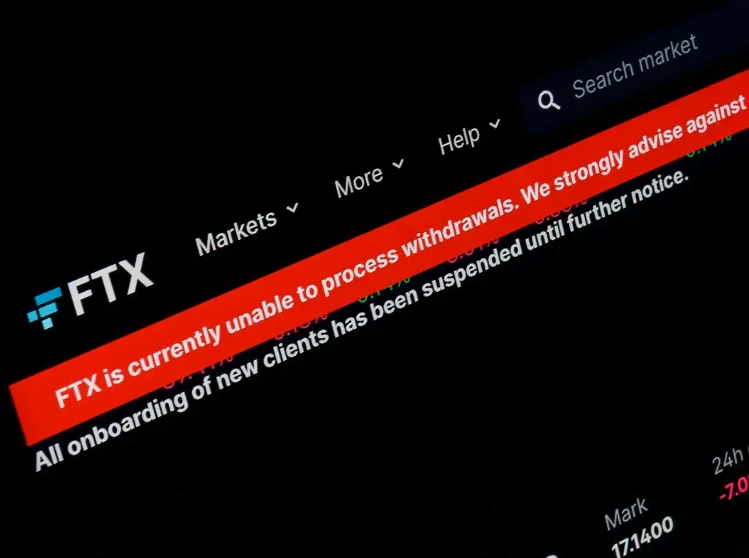

In the end, there was a bank run, which showed that FTX was not backing user funds 1:1 behind the scenes. This meant that the company could not fulfill withdrawal requests without billions of dollars in rescue capital.

Now, Zhou says, the company is thinking about whether it should keep doing business as usual, try to buy another company, or become a proprietary trading shop.