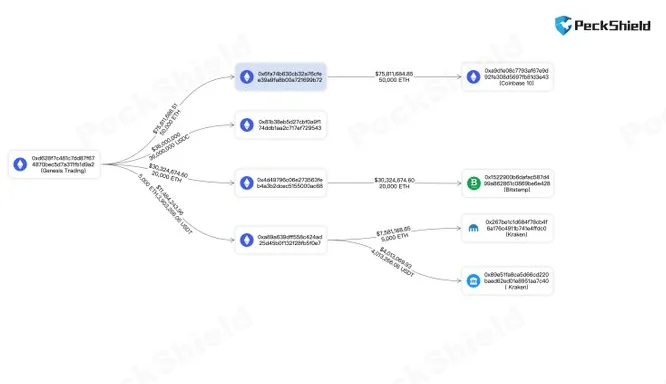

In the wake of its Chapter 11 bankruptcy protection filing, Genesis Trading has transferred crypto assets including ETH, USDT, and USDC worth millions to other crypto exchanges.

PeckShieldAlert, a blockchain security platform, revealed several million in crypto assets moved by Genesis Trading in a tweet on January 20.

From its OTC Desk, Genesis Trading sent 75k Ethereum (ETH) valued at $113.7 million and 4 million USDT to Coinbase, Bitstamp, and Kraken. 20k ETH was sent to Bitstamp, 5k ETH and 4 million USDT were sent to Kraken, and 50k ETH was sent to Coinbase.

Furthermore, it moved 36 million USDC to the new address 0x81b3…543. The Whale Alert platform also noticed significant ETH movements.

Crypto Twitter responded to the transfers made by Genesis Trading in the midst of its loan company Genesis Global Capital declaring bankruptcy. Some people think the company is selling off assets to make room for paying back creditors’ demands.

Nansen claims that $43.7M USDT net withdrawals from Kraken and $51.9M USDC net transfers to Coinbase represent Genesis’ highest CEX transactions over the last 30 days. $28.7M in net ETH deposits to Bitstamp, $19M in net USDT withdrawals from OKX, $10.8M in net USDT withdrawals from Binance, and $7M in net USDC deposits.

Given that parent company Digital Currency Group and creator Barry Silbert were unable to strike an agreement with creditors, some analysts are likely to have forecast Genesis’ bankruptcy. The crypto contagion from FTX prevented investors from making more investments in the company, despite its plans to seek $1 billion in emergency finance.

Genesis Global files for bankruptcy

Genesis Capital halted withdrawals and redemptions for a number of loan programs, including the Earn program offered by cryptocurrency exchange Gemini.

After Genesis filed for Chapter 11 bankruptcy, Gemini co-founder Cameron Winklevoss said that the company will proceed with its plan to bring a lawsuit against Barry Silbert, the creator of Digital Currency Group, and other individuals in order to recoup client monies.

Almost $150 million in cash is presently available to the cryptocurrency lender to facilitate restructuring. Over 100,000 creditors are listed along with assets and liabilities totaling between $1 billion and $10 billion in the court document.