Following the U.S. Securities and Exchange Commission’s (SEC) lawsuits against Coinbase and Binance, the value of several memecoins depicting the SEC and its chairman, Gary Gensler, has increased dramatically.

One such token is Good Gensler (GENSLR), which increased by more than 260% following the regulator’s June 6 complaint against Coinbase for offering unregistered securities.

Good Gensler has a current market capitalization of approximately $3.2 million. The token has had a 24-hour trading volume of just over $1.25 million. Etherscan data indicates that Good Gensler was launched on April 19, five days after fellow memecoin Pepe (PEPE).

Similarly, another Gensler-derived memecoin with the profanity-laden name Fuck Gary Gensler (FKGARY) also experienced some upward momentum, surging more than 530% in the last 48 hours, according to data from the DEXTools decentralized exchange (DEX) screener.

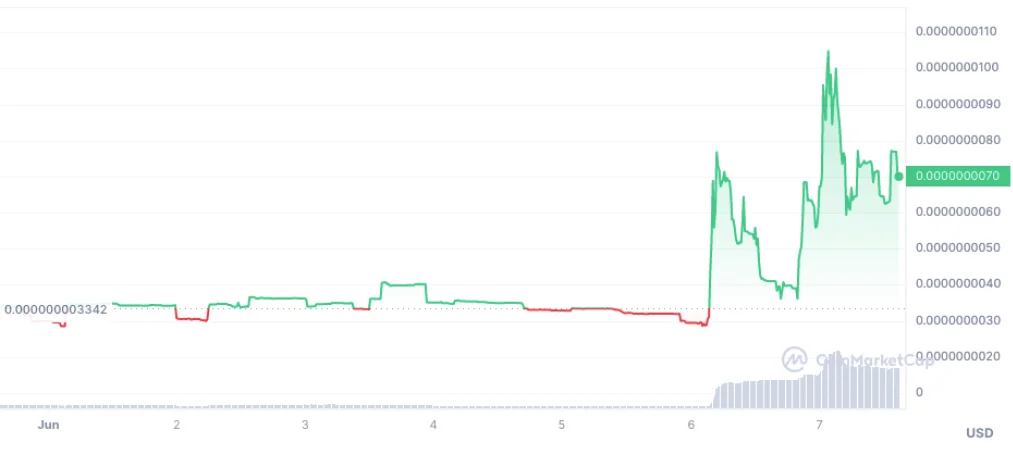

Not only Gensler was targeted by memecoin enthusiasts. Another token with the ticker “SEC” — “Stupid Egotistical Cocksuckers” — encountered significant volatility in response to the recent actions of the regulator. The SEC token was introduced on June 5 and gained a staggering 15,530% the following day.

However, the value increase was temporary. At the time of writing, the SEC-themed memecoin’s price has fallen by over 61% from its all-time high.

Risk-hungry traders flocked to hyper-speculative tokens in a desperate search for rapid, outsized gains in May. Unfortunately for the vast majority of memecoin investors, the vast majority of tokens that were popular during the frenzy have seen their value plummet.

According to CoinGecko data, at the time of publication, the price of the frog-themed memecoin Pepe and the artificial intelligence-created token Turbo (TURBO) are down 73% and 95% from their all-time highs.

Because most memecoins lack underlying fundamentals, investing in them is considered a high-risk endeavor, as many have experienced extreme volatility and significant price fluctuations.

Numerous tokens mentioned in this article have small market capitalizations and low liquidity in their respective liquidity pools, making them highly susceptible to price fluctuations.