Google has revised its advertising policy regarding cryptocurrencies to permit advertisements for US-based-crypto trusts beginning at the end of January, coinciding with the anticipated approval of spot Bitcoin exchange-traded funds (ETFs).

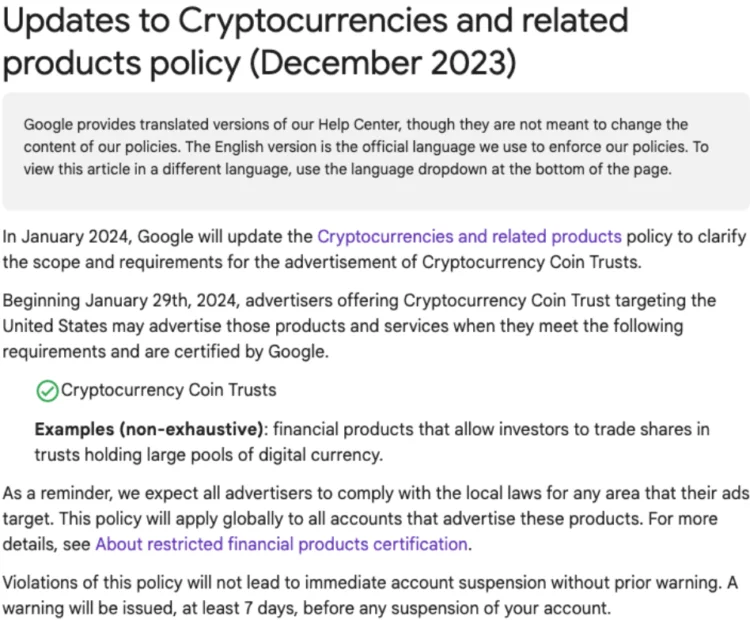

In a policy change log dated December 6, Google stated that its ad policy for cryptocurrencies and associated products will be revised on January 29, 2024, to permit advertisements from “advertisers offering Cryptocurrency Coin Trust targeting the United States.”

Examples of “financial products that enable investors to trade shares in trusts that hold substantial quantities of digital currency” were cryptocurrency coin trusts, which likely include ETFs.

“All advertisers must adhere to the local regulations governing the specific regions their advertisements aim to reach. “Google further stated that this policy will be universally applicable to all accounts that promote these products.”

Ads for prospective cryptocurrency trusts must be Google-certified. “Their products, landing pages, and ads must comply with all local legal requirements of the country or region for which they wish to obtain certification.” Certification also pertains to the advertiser possessing the proper license from the relevant local authority.

Google prohibits advertisements for nonfungible tokens (NFTs)- based wagering platforms, initial coin offerings, decentralized finance protocols, and services that provide trading signals. Still, it does permit advertising for some crypto and related products.

The policy shift comes as Bloomberg ETF analysts project a 90% chance that a U.S. spot Bitcoin ETF will be approved by January 10, 2024, with the possibility that multiple pending applications will be approved simultaneously.

There are thirteen applicants for Bitcoin ETFs, and information regarding their approval procedures is scarce. According to reports, several fund managers, such as Fidelity, Grayscale, and BlackRock, recently convened with the U.S. Securities and Exchange Commission to discuss “critical technical details” regarding their ETF bids.

The cryptocurrency industry wagers on approvals. Bitcoin has risen by approximately 74% in the past ninety days, and some analysts anticipate it will reach a fresh all-time high in 2024.