Grayscale Investments, a digital asset management, has launched seven smart contract platforms other than Ethereum. The funds include ADA, SOL, AVAX, DOT, MATIC, ALGO and XLM.

The Grayscale Smart Contract Platform Ex-Ethereum Fund, also known as the GSCPxE Fund, is Grayscale’s 18th investment product. At the following weightings, the fund will give exposure to seven smart contract platforms:

- Cardano (ADA): 24.63%

- Solana (SOL): 24.27%

- Avalanche (AVAX): 16.96%

- Polkadot (DOT): 16.16%

- Polygon (MATIC): 9.65%

- Algorand (ALGO): 4.27%

- Stellar (XLM): 4.06%

Accredited investors can now subscribe to the new fund on a daily basis, according to Grayscale.

Ethereum smart contract platform

Competitors claiming to offer faster transaction speeds, lower costs, and higher throughput capacity are challenging Ethereum’s dominance as the leading smart contract platform. While Ethereum remains the undisputed leader in the decentralized application area, the DeFi business is growing more competitive.

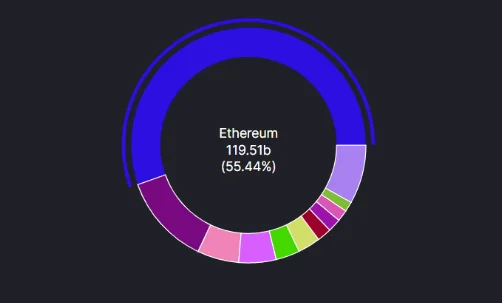

According to DeFi Llama, Ethereum currently accounts for slightly over 55.4 percent of the entire wealth locked on DeFi protocols, down from over 96 percent in January 2021.

With over $36 billion in assets under management as of March 22, Grayscale is by far the largest digital asset manager in the world. During the peak of Bitcoin’s (BTC) record-breaking rise in November 2021, assets under management surpassed $60 billion.

With nearly $26.4 billion in assets, the Grayscale Bitcoin Trust, or GBTC, is the largest offering.