Bitcoin seems to fit the idea of an energy-backed currency established by a famous American inventor during the interbellum period.

In 1921, American manufacturer Henry Ford proposed the establishment of an “energy currency” that might serve as the foundation for a new monetary system, eerily similar to Satoshi Nakamoto’s 2008 Bitcoin (BTC) whitepaper’s peer-to-peer electronic cash system.

Bitcoin as an energy currency

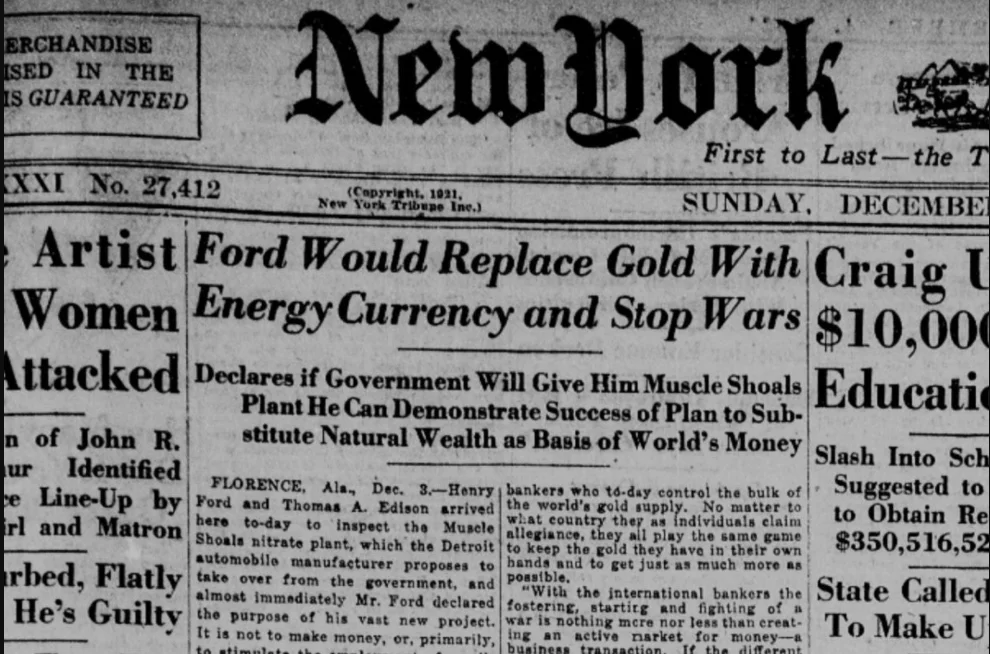

The New York Tribune published an article on Dec. 4, 1921, explaining Ford’s idea of replacing gold with an energy currency that would stop wars and undermine the banking elites’ grip on world riches. He planned to accomplish this by constructing “the world’s greatest power plant” and establishing a new financial system based on “power units.”

According to Henry Ford, who started Ford Motor Company in 1903,

“Under the energy currency system the standard would be a certain amount of energy exerted for one hour that would be equal to one dollar. It’s simply a case of thinking and calculating in terms different from those laid down to us by the international banking group to which we have grown so accustomed that we think there is no other desirable standard.”

He added the intricacies of currency values would be hammered out “when Congress is interested in hearing about it.”

Despite the fact that Ford’s ideal of a fully supported money was never realised, Bitcoin appears to have vindicated the concept a century later. Since 2009, energy-intensive mining has produced more over 18.8 million BTC, which requires computers to solve increasingly complicated arithmetic problems. The supposed environmental impact of this proof-of-work mining mechanism has sparked outrage, but this is a short-sighted assertion that ignores Bitcoin’s ability to hasten the transition to renewable energy.

Replacing gold, ending wars

Ford stated the link between gold and conflict as follows:

“The essential evil of gold in its relation to war is the fact that it can be controlled. Break the control and you stop war.”

Some of Bitcoin’s most fervent supporters believe that the cryptocurrency’s sound money principles have the potential to eradicate war by limiting the state’s capacity to finance conflict through inflation.

While a gold standard makes it more difficult for nations to inflate their currency, Ford said that “international bankers” controlled the majority of the bullion supply. This strategy of owning and amassing valuable goods enabled financial elites to establish an active money market that thrived during times of war.

President Richard Nixon of the United States abandoned the gold standard in 1971, stating that his administration would temporarily restrict convertibility between dollars and bullion. The so-called quasi-gold standard would survive until 1973, after which all references to the dollar being backed by bullion would be phased out by 1976.

However, the British government effectively abolished the gold standard system in 1931, followed by the United States two years later.

Related: On the 50th anniversary of Bretton Woods, a Bloomberg strategist predicts that bitcoin will eventually supplant gold.

On Saturday, the New York Tribune piece was shared on Reddit’s r/CryptoCurrency page, where it earned a large number of upvotes. While Satoshi Nakamoto made no reference to Henry Ford in online forum discussions, some Reddit users theorised that the late manufacturer influenced Bitcoin’s founder.

Others joked that Satoshi might be Ford’s reincarnation, considering the latter’s apparent belief in reincarnation.