Hidden Road, a brokerage firm sponsored by Citadel, has formally restricted its clients’ access to the ByBit exchange, citing KYC verification policies and AML regulations.

As reported by Bloomberg, a divergence in Know Your Customer (KYC) verification protocols and Anti-Money Laundering (AML) regulations between Hidden Road and ByBit led to the restriction on services.

ByBit retorted that it would audit its brokerage division to verify the accurate implementation of regulatory policy.

Anti-money laundering and Know Your Customer regulations have emerged as contentious issues in decentralized finance, dividing the cryptocurrency community.

The academic journal Policy Design and Practice published research indicating that AML regulations had a minimal impact on illicit financial activities.

“Anti-money laundering policy intervention has less than 0.1 percent impact on criminal finances, compliance costs exceed recovered criminal funds more than a hundred times over, and banks, taxpayers and ordinary citizens are penalized more than criminal enterprises,” according to the study.

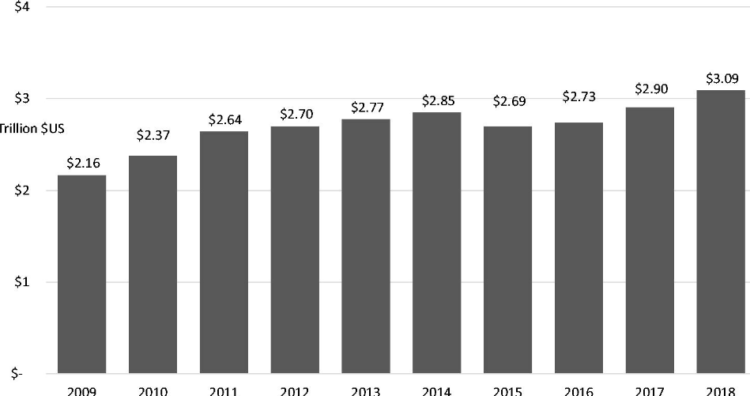

In 2018, total global proceeds from illicit activity constituted a mere 3.6% of total GDP, according to academic research. This proportion has remained relatively constant across all surveyed years before 2018.

Several initiatives, including Monero, Samurai Wallet, and Tornado Cash, have attempted to bypass these regulations by providing users with cryptocurrency aggregator and tumbler services.

In April, federal authorities in the United States detained the developers of Samurai Wallet, Keonne Rodriguez, and William Lonergan Hill, on suspicion of violating money laundering laws.

Both developers were charged by the U.S. Department of Justice (DOJ) with conspiring to launder money and operate an unauthorized money transmission service.

The U.S. Treasury accused Tornado Cash of facilitating money laundering and moved to prosecute and arrest the founders of the popular mixing service well before the DOJ targeted Samurai Wallet.

In 2022, the developers of Tornado Cash were on the run from accusations by U.S. officials and their European allies that they had laundered $7 billion in digital assets.

Following their involvement in the mixer protocol, developers of Tornado Cash, namely Roman Storm, Alexey Pertsev, and Roman Semenov, were all formally prosecuted and arrested.

Because of his involvement in the project, Dutch authorities arrested and tried Pertsev, who is presently serving 64 months in prison.