Hodlnaut, a crypto lending firm based in Singapore, has been forced to liquidate its assets after suffering huge losses in the Terra/Luna and FTX debacles. The company’s users and creditors are left in limbo as the liquidation process unfolds.

Hodlnaut crypto lending platform, has announced its liquidation after failing to recover from the massive losses it incurred in the crypto market crash of 2022.

The company, which had over 17,000 users and $300 million in assets under management, was hit hard by the collapse of the Terra/Luna ecosystem and the FTX exchange.

Terra/Luna and FTX disasters

Hodlnaut’s troubles began when it lost $189.7 million in the Anchor Protocol, a decentralized finance (DeFi) platform that offered high interest rates for the Terra stablecoin UST.

The Anchor Protocol was shut down in December 2022 after a series of hacks and exploits drained its funds. Hodlnaut had invested a large portion of its assets in the protocol, hoping to generate returns for its users.

To make matters worse, Hodlnaut also lost over $13 million of its assets in the bankruptcy of the FTX exchange, one of the largest and most popular crypto trading platforms.

FTX went under in January 2023 after a series of technical glitches, security breaches, and regulatory pressures. Hodlnaut had used FTX as its custodian and liquidity provider, exposing its funds to the exchange’s downfall.

Restructuring and liquidation

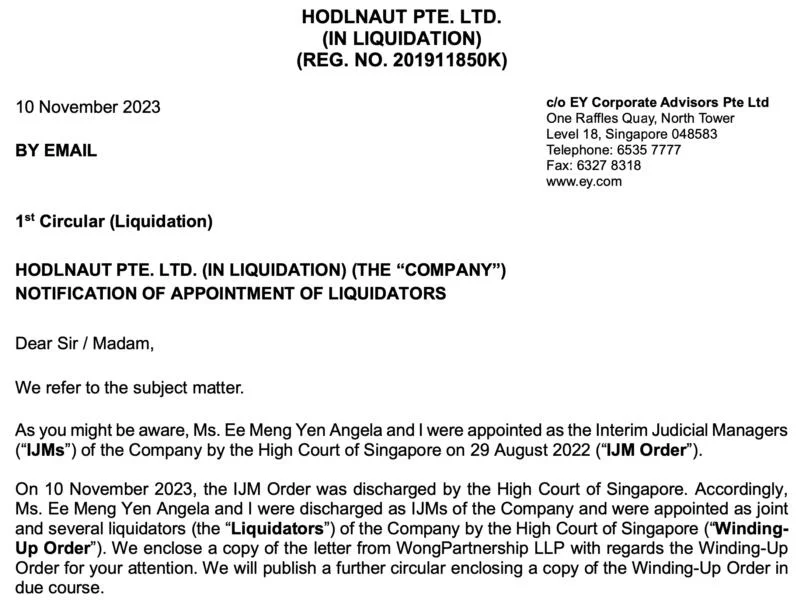

Facing insolvency, Hodlnaut sought judicial management in February 2023, a legal process that allows a company to restructure its debts and operations under court supervision.

The company hoped to avoid immediate liquidation and protect its remaining crypto assets from a forced sell-off. It also informed its users that it had halted withdrawals and withdrew its license application from the Monetary Authority of Singapore (MAS).

However, Hodlnaut’s restructuring plan was met with opposition from its creditors, who rejected the proposal and voted for liquidation instead.

The creditors, which included the Algorand Foundation and other crypto entities, argued that liquidation would better preserve the value of the company’s remaining assets and allow for a fairer distribution among the stakeholders.

The court approved the liquidation decision in January 2023 and appointed the auditing firm EY as the liquidator.

Hodlnaut under legal scrutiny for false claims

Adding to Hodlnaut’s woes, the company also faced a police investigation for allegedly making false representations about its exposure to a certain digital token.

The investigation, launched in November 2022, added a layer of legal scrutiny to the company’s already precarious situation.

The police did not disclose the details of the investigation or the token involved, but some speculate that it could be related to the Terra/Luna debacle.

The liquidation of Hodlnaut marks the end of a turbulent chapter for the crypto lending firm and its users. The company, which was once hailed as a pioneer and innovator in the crypto space, fell victim to the volatility and risks of the crypto market.