DeFi has rapidly gained traction as a revolutionary force in finance. At the center of DeFi is decentralized oracles, a critical component influencing the efficacy and security of DeFi platforms. This article will explore how decentralized oracles impact DeFi lending and borrowing.

What is DeFi?

DeFi, short for Decentralized Finance, refers to financial services and applications built on blockchain and cryptocurrency technologies, primarily operating on decentralized networks.

The core idea behind DeFi is to recreate and improve upon traditional financial systems, such as banking and lending, without the need for traditional intermediaries like banks and other financial institutions.

Oracles are very essential in the Defi ecosystem. Blockchains must connect with the external world since blockchain helps eliminate intermediaries and provide financial services through smart contracts. Due to decentralized oracles, accurate price feeds, crypto loans, collateral, and buy and sell orders are all feasible features in Defi.

Understanding Decentralized Oracles

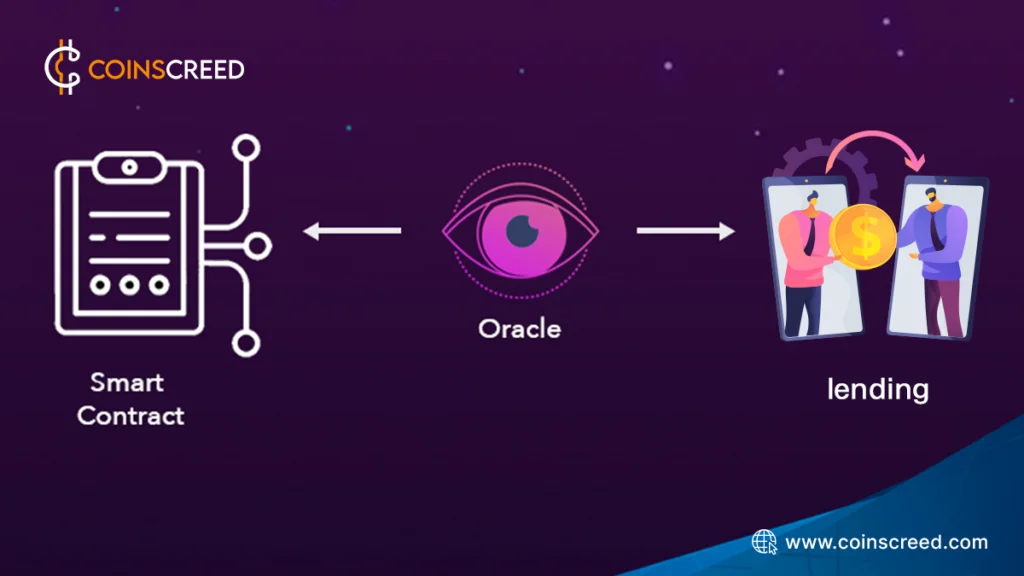

Decentralized oracles are the bridge connecting the blockchain to the outside world. Their purpose is to fetch and verify external data, making it available for smart contracts to execute predetermined actions based on these data points.

They enable smart contracts to use weather data, stock prices, or election results. Oracles have many practical and powerful applications, from DeFi to crop insurance.

As blockchains cannot access off-chain data by themselves, oracles are a valuable third-party service that dramatically expands the use cases for smart contracts.

While oracles can theoretically access any data in the physical world, building consensus from real-world information can be challenging.

How do Decentralized Oracles Work?

Closely relating to the Bitcoin and Ethereum blockchain, oracle networks can be incentivized using game theory mechanisms.

Oracles that provide accurate information to the network are rewarded, while those that submit false information are punished. In this way, oracles aim to provide data with the same degree of immutability, accuracy, and decentralization.

It’s important to emphasize that decentralized oracles are not the actual data. Instead, oracles are the tools that verify external data sources and relay the information.

A decentralized oracle lets developers access data stored on the blockchain from the real world. They take information from the physical world using off-chain components such as Internet of Things (IoT) devices, online databases, or websites. This information is then put on the blockchain using a smart contract.

Types of Oracles

DeFi lending, borrowing, and smart contracts may use various decentralized oracles. Now let’s take a look at some of such oracles:

- Price oracles

- Random number oracles

- Time oracles

- Event-based oracles

- Volume oracles

Price Oracles

These oracles are designed to provide real-time and historical price data for assets, cryptocurrencies, and other financial instruments. They play a crucial role in determining the value of collateral and assessing loan-to-value ratios in DeFi lending protocols.

Random Number Oracles

Random number oracles are utilized when randomness or unpredictability is required, such as for gaming or lottery applications within DeFi lending platforms.

Event-Based Oracles

These oracles focus on specific events or triggers, such as predetermined market conditions, contract expirations, or specific external occurrences that may impact the terms of a loan or a borrowing arrangement.

Volume Oracles

Volume oracles provide information on the trading volume of assets, which can be essential for determining liquidity and market activity, particularly in collateralized DeFi lending models.

Time Oracles

Time oracles supply accurate time and date data, ensuring that loan agreements, interest calculations, and other time-sensitive aspects of DeFi lending operate reliably and consistently.

The Role of Decentralized Oracles in DeFi Lending and Borrowing

DeFi platforms have redefined traditional financial services by directly offering lending, borrowing, trading, and yield farming on the blockchain.

However, DeFi protocols require real-time market data, asset prices, interest rates, and more to execute these financial activities effectively.

Oracles are instrumental in providing this critical information, ensuring the accuracy and reliability of DeFi applications.

For DeFi lending, decentralized oracles provide real-time asset prices and essential market data.

Smart contracts use this information to calculate interest rates, collateral valuations, and loan issuance.

Decentralized oracles enable smart contracts to verify the value of collateral assets and broader market conditions, ensuring that loans are issued based on accurate and up-to-date data.

How Decentralized Oracles Impact DeFi Borrowing

Decentralized oracles facilitate the automated determination of interest rates for borrowers, ensuring fairness and transparency in the borrowing process.

With decentralized oracles providing accurate asset valuations, DeFi platforms can offer overcollateralized or undercollateralized lending options, expanding access to financial services.

Decentralized oracles also help address challenges related to credit scoring and risk assessment by providing reliable data that can be used to evaluate a borrower’s creditworthiness.

Security, Challenges, and Potential of Decentralized Oracles

One of the challenges facing decentralized oracles is the potential for security vulnerabilities in the data aggregation process, which could lead to inaccurate or manipulated data being fed into smart contracts.

As the DeFi ecosystem grows, decentralized oracles will evolve to meet the demand for more diverse and complex data inputs.

Their potential to reshape the DeFi landscape is significant, paving the way for more innovative financial products and services.

Real-World Examples of Decentralized Oracles in DeFi Lending and Borrowing

Chainlink

Chainlink is an Oracle network that bridges real-world data to blockchain networks via smart contracts. It is an intermediary to transfer data between non-blockchain platforms and smart contracts.

Essentially, the platform takes real-world data (i.e., real-time price data captured via an API) and moves it to smart contracts on the blockchain (a Defi protocol, for example).

All of this occurs on the LINK network, the decentralized Oracle ecosystem on which the platform is based.

LINK is the platform’s native token, and it powers the ecosystem by compensating users who participate in the network, for example, as a data provider.

Chainlink is the first oracle platform in the blockchain space and has integrated with over 475 protocols, including Defi projects and node operators.

QED

QED is a decentralized oracle system that, like Chainlink, brings real-world data onto the blockchain.

The protocol aims to create a trustless ecosystem by spreading data points across many organizations and modeling the blockchain network. The protocol uses external collateral without relying on a native token, avoiding issues like the collapse seen with Terra (LUNA).

The Oracle protocol uses an incentive model to optimize returns for users in the network. This helps improve both the ecosystem’s health and the token’s value.

In addition, the protocol only works with Oracles with a history of doing bad work. Instead, it directs fees toward Oracles, which has a history of being accurate and trustworthy.

Lastly, the platform’s token ensures the network has a decentralized billing facility to prevent malicious actors from working together to defraud the network.

Oraichain

Oraichain is a blockchain and data oracle platform focusing on smart contracts and artificial intelligence API aggregation and integration. The platform also transmits data to decentralized applications using artificial intelligence and smart contract technology.

Transaction times on the network are fast due to its delegated proof-of-stake (dPoS) algorithm. The ORAI token governs the platform and serves as gas for transaction fees and payment for data requests on the network.

In addition, AI suppliers must pass test cases sent by data enquirers. The suppliers must pass the test case before receiving payment to source the data request. This is done by improving the accuracy of AI models used on the network.

BAND Protocol

The BAND Protocol functions as a decentralized cross-chain oracle, enabling smart contracts to acquire data from any API or other external data source efficiently and reliably.

It is software intended to incentivize users to send data from the real world to decentralized apps operating on blockchains.

The protocol initially went live on the Ethereum network before building its Cosmos-based blockchain network. The platform has a system of validators selected based on the number of BAND tokens they hold.

Once selected, the validator can verify and add new transactions to the BAND network. Like Chainlink, they plan to reconcile real-world data with blockchain-based protocols and applications.

Conclusion

Decentralized oracles are important technological mechanisms crucial for the growth, global evolution, and adoption of blockchain systems.

Decentralized oracles have decisively transformed the DeFi lending and borrowing landscape, enabling a more secure, transparent, and inclusive financial environment.

DeFi and decentralized oracles are still developing, but they have a lot of potential to change the global financial landscape, make financial services more accessible to everyone, and encourage new ideas in the decentralized economy.