Welcome to our comprehensive guide on how to spot trends in cryptocurrency market cycles and make better investment decisions. This article will explore proven strategies and techniques to help you identify trends, analyze market cycles, and ultimately increase your chances of success in the ever-changing cryptocurrency market.

Whether you’re a seasoned investor or a beginner, this article will provide valuable insights to navigate the cryptocurrency landscape effectively.

What Is A Crypto Market Cycle?

A crypto market cycle refers to the periodic fluctuations and patterns in the cryptocurrency market over time. It is characterized by alternating periods of growth, known as bull markets, and periods of decline, known as bear markets. Investor sentiment, market adoption, regulatory developments, technological advancements, and macroeconomic conditions drive these cycles.

Phases In A Crypto Market Cycle

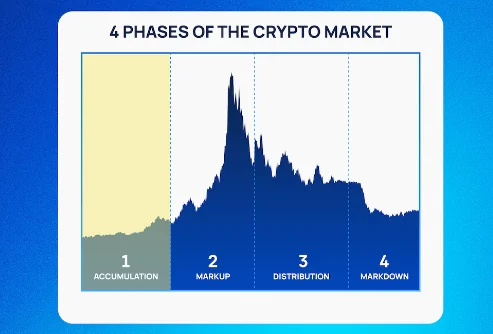

The typical crypto market cycle consists of several phases:

- Accumulation phase

- Markup phase

- Distribution phase

- Markdown phase

Accumulation Phase

This phase occurs after a bear market, where prices have bottomed out, and investor sentiment is low. During this phase, prices generally trade sideways, and savvy investors start accumulating cryptocurrencies at lower prices.

Markup Phase

The markup phase marks the beginning of a bull market. Prices start to rise as buying pressure increases, and optimism and enthusiasm among investors grow. This phase often experiences significant price appreciation and increased trading volumes.

Distribution Phase

The market enters a distribution phase as prices rise and reach new highs. Early investors and traders begin selling their holdings to take profits during this phase, leading to consolidation and potential price corrections.

Markdown Phase

The markdown phase indicates the transition from a bull market to a bear market. Prices start declining, and negative sentiment takes over as more investors sell off their positions. This phase can be volatile and marked by sharp price drops.

Accumulation Phase (Repeat)

After a significant markdown, the market enters another accumulation phase, starting the cycle anew.

It’s important to note that the duration and magnitude of each phase can vary in different market cycles. Additionally, the crypto market is highly speculative and influenced by various external factors, making it challenging to predict each phase’s exact timing or duration.

How to Spot Trends in Cryptocurrency Market Cycles

To spot trends in cryptocurrency market cycles, you must first understand cryptocurrency market cycles. Here are some ways to spot trends in the crypto market:

- Historical data analysis

- Understand the key indicators for trend spotting

- Fundamental factors

- Data analytics tools

- Recognizing Patterns and Indicators

- Portfolio Diversification

- Staying Informed and Adapting

Historical Data Analysis

One of the most effective ways to spot trends in cryptocurrency market cycles is through historical data analysis.

Technical analysis tools play a vital role in this process. Moving averages, trendlines, and oscillators are potent tools that help identify market trends and potential turning points. By studying price charts and patterns, you can gain valuable insights into the market’s direction.

Understand The Key Indicators for Trend Spotting

Two key indicators to consider when analyzing cryptocurrency market cycles are:

- Volume

- Liquidity

Monitoring trading volumes can provide valuable insights into market interest and participation. Volume spikes during specific periods often indicate potential trends and significant price movements.

Additionally, sentiment analysis, which involves monitoring social media platforms, news articles, and forums, can provide valuable information on a cryptocurrency’s overall sentiment.

Fundamental Factors

While technical analysis is essential, it is equally important to consider fundamental factors when spotting trends in cryptocurrency market cycles.

Stay updated with news and events that impact the market, including regulatory changes, partnerships, and project updates. Fundamental analysis provides a broader perspective and helps you make more informed investment decisions.

Data Analytics Tools

Several data analytics platforms are available in the cryptocurrency market to aid in trend spotting.

CoinMarketCap, CoinGecko, and TradingView are popular platforms that offer comprehensive market data, including historical price data, trading volume, and market capitalization.

Utilize these platforms’ advanced tools and indicators to understand market trends better.

Recognizing Patterns and Indicators

Chart patterns are repetitive formations that occur in cryptocurrency markets. Recognizing these patterns can help predict potential trend reversals or continuations, giving you a significant advantage in making profitable investments.

Triangles, head and shoulders, and double tops or bottoms are common chart patterns worth studying and incorporating into your trend-spotting strategy.

Portfolio Diversification

Diversifying your cryptocurrency portfolio is essential for managing risk and maximizing returns.

By allocating your investments across different cryptocurrencies and market sectors, you can minimize the impact of adverse price movements and increase your chances of capitalizing on emerging trends.

A well-diversified portfolio provides stability and mitigates the risk associated with individual cryptocurrencies.

Staying Informed and Adapting

The cryptocurrency market is dynamic and constantly evolving. Staying informed about the latest developments, market news, and technological advancements are crucial to spot trends effectively.

Engage in communities, follow influential figures, and attend conferences to stay ahead of the curve. Continuously adapt your strategies based on new information and changing market conditions to maintain a competitive edge.

Conclusion

Spotting trends in cryptocurrency market cycles is a skill that can significantly improve your investment decisions. By leveraging historical data analysis, key indicators, fundamental analysis, and data analytics tools, you can identify trends and position yourself strategically in the market.

Remember to diversify your portfolio and stay informed about the latest market developments. With continuous learning and practice, you can become a more confident and booming investor in the exciting world of cryptocurrencies.