On-chain data indicates that Bitcoin holders are amassing BTC, as the proportion of inactive BTC supply reaches all-time highs across one-, three- and five-year time domains.

According to the Bitcoin supply, the last active chart on Glassnode, inactive BTC that has not moved from an address for more than one, three, and five years, has reached all-time highs since July 2023.

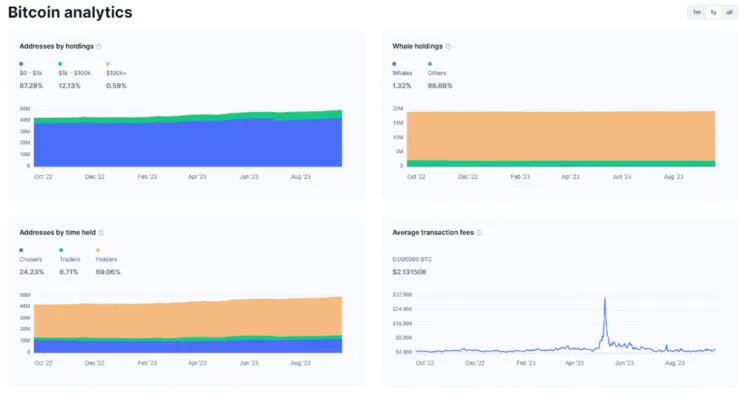

These metrics are mirrored by Bitcoin analytics from CoinMarketCap, which monitors the time wallet addresses have held BTC. 69%, or 36.8 million addresses, have held Bitcoin for over a year.

Since July 2021, Bitcoin outflows from exchanges have consistently decreased, with just over 2 million BTC remaining on exchanges.

The CoinGlass Bitcoin on exchanges tracker categorizes the BTC held by the largest centralized exchanges.

Binance ranks first on the list with 543,281 BTC, but the exchange has experienced significant Bitcoin withdrawals over the past 30 days, with 21,645 BTC withdrawn.

Coinbase Pro’s BTC balance of 435,530 BTC places it second on the list, with 3,612 BTC being withdrawn from its platform over the past 30 days.

OKX is the only exchange in the top 10 to have seen a significant influx of Bitcoin in the last 30 days, with 4,630 BTC entering the platform last month.

The anticipated halving of Bitcoin’s mining reward in 2024 has led market commentators and analysts to make optimistic projections about the cryptocurrency’s potential value.