India is set to launch a new digital payment infrastructure, e-Rupi this will facilitate transparent and leak-proof payment transfer initiated by several payment services.

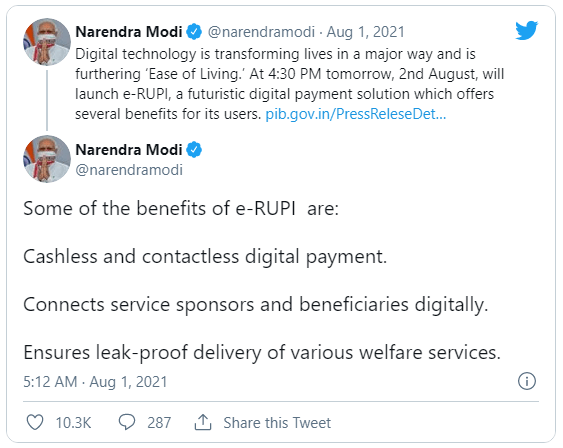

India’s digital payments system is about to undergo a big revamp later today! Prime Minister Narendra Modi said on Sunday, August 1 that on Monday, August 2 at 4:00 p.m. IST, he will launch e-RUPI, a futuristic digital payment solution.

The e-RUPI initiative intends to transition India to a cashless and contactless digital payment economy. It will also aid in the creation of a clear digital bridge between service providers and recipients.

It would also ensure that no leakage occurs in the delivery of welfare services undertaken by the Indian government.

This new payment system was created by the National Payments Corporation on the same platform as UPI (Unified Payments Interface). The following is from the announcement:

e-RUPI connects the sponsors of the services with the beneficiaries and service providers in a digital manner without any physical interface.

It also ensures that the payment to the service provider is made only after the transaction is completed. Being pre-paid in nature, it assures timely payment to the service provider without the involvement of any intermediary.

The e-RUPI payment system has a variety of applications.

As previously stated, the e-RUPI is a step toward increasing the use of digital payments in India. However, it is unclear whether India’s CBDC objectives will be aided by the e-RUPI system.

The government appears to be primarily focused on using the e-RUPI system to offer welfare benefits in a leak-proof manner.

It will also be used to offer drugs and nutritional support “under Mother and Child Welfare schemes, TB eradication initiatives, drugs and diagnostics under schemes such as Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertilizer subsidies, and so on.”

Corporates may find the e-RUPI digital vouchers handy, according to the press release. These vouchers can be used by private players as part of employee welfare and corporate social responsibility programs.

The launch of e-RUPI appears to be the Indian government’s preparation for more complex infrastructure, such as the central bank digital currency (CBDC). The Reserve Bank of India (RBI), India’s central bank, has expressed interest in launching the Digital Rupee.

Regulators in India, on the other hand, have been slow to set guidelines for the usage of digital currencies. As a result, establishing a CBDC remains a pipe dream.