As the price of LUNA 2 tanks, many investors are moving to completely dump the Terra project.

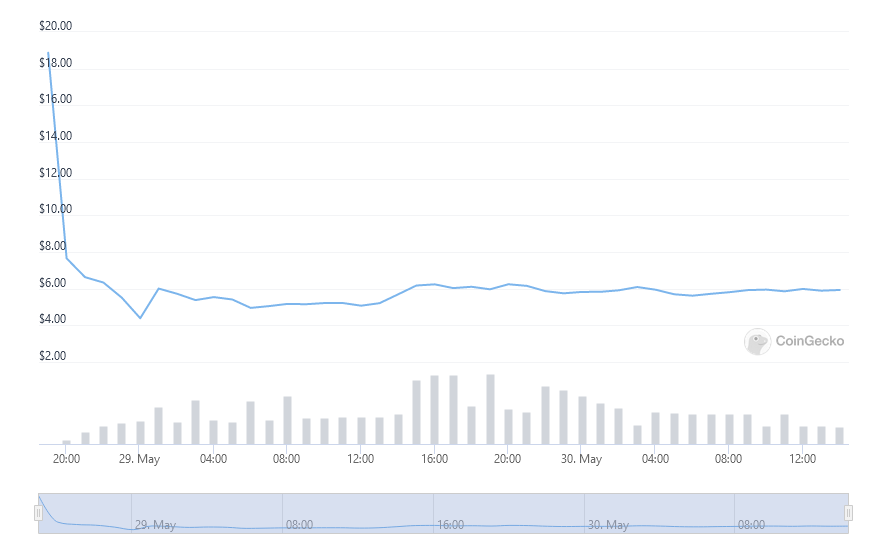

Since the re-launch of the Terra ecosystem via Terra 2.0 on May 28, the price of LUNA has dropped by roughly 70%.

New LUNA tokens (also known as LUNA 2) are being airdropped to investors who previously held Luna Classic (LUNC), TerraUSD Classic (USTC), and Anchor Protocol UST as part of Terraform Labs founder Do Kwon’s revival plan (aUST).

LUNA has dropped roughly 69 percent from its opening price of $18.87 on Saturday to around $5.71 at the time of writing, according to CoinGecko data.

At this point, the sharp drop appears to indicate a lack of confidence in Do Kwon’s revamp moving forward, with many investors indicating on Twitter that they are instead looking to recover a small portion of their previously lost capital and walk away from the project.

Beginning on May 31, Binance will begin a multi-year distribution of LUNA to eligible users, as well as list the token for trading via its Innovation Zone, a dedicated trading zone for volatile and high-risk assets.

Some members of the community, such as “lurkaroundfind,” who have stated their intention to purchase it once the carnage is over, have predicted even more bloodshed once the Binance drop goes live.

They stated that Binance has “15.7MM liquid LUNA, which will be available to users on Tuesday,” and that investors who primarily used the Anchor Protocol will look to cash out because they have no real interest in the Terra ecosystem. However, there is still uncertainty about what the future of Terra portends.

Popular influencers in the space, such as Lark Davis, have also made such observations, telling his 988,000 Twitter followers yesterday:

“Zero plans to buy $luna 2.0, but I will dump any airdrop if I get something on Binance.”