Yuichiro Tamaki, leader of Japan’s Democratic Party for the People, promised to lower crypto tax rates to 20% if elected, aligning them with stock market taxes.

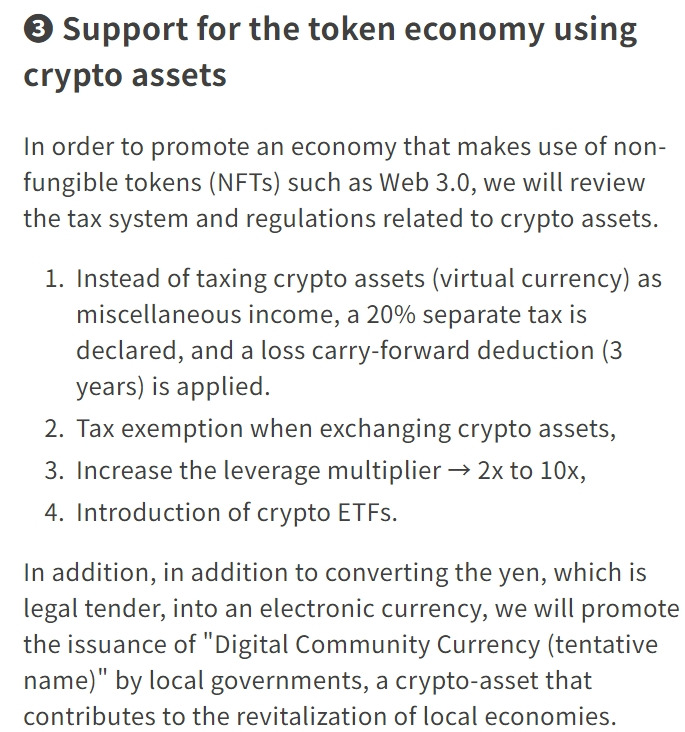

Yuichiro Tamaki, the leader of Japan’s Democratic Party for the People (DPP), has submitted a crypto tax proposal that would reduce the tax rate on crypto gains to 20% if he is elected.

In a translated X post on Oct. 20, Tamaki stated, “If you believe that crypto assets should be taxed separately at 20% instead of being treated as miscellaneous income, please vote for the Democratic Party for the People.”

However, the plan may not be realized anytime soon, as Tamaki’s DPP currently occupies only seven of the 465 seats in Japan’s Chamber of Representatives, the lower chamber of the National Diet of Japan.

Aligning crypto gains with the taxes paid on stock market profits would necessitate a 20% tax rate.

Under Tamaki’s proposal, no tax event would be associated with exchanging one crypto asset for another.

Tamaki emphasized, “I would be grateful if you could disseminate information regarding the Democratic Party’s commitments to the people.”

Tamaki responded to Shonai Dog, an X user, by stating that the DPP would contemplate implementing tax cuts on other financial income in the future. However, at present, the party is concentrated on establishing Japan as a leader in the Web3 sector.

“We want to make Japan a strong nation in the Web3 business.”

The election in Japan is scheduled for October 27. The DPP’s primary message to electors is that they should increase their take-home pay to surpass inflation.

Japan’s Financial Services Agency announced on August 30, 2018, plans for a comprehensive revision of the nation’s tax code for fiscal year 2025. These plans included provisions to reduce taxes on crypto assets.

Currently, the tax rate on cryptocurrency profits in Japan is miscellaneous income, ranging from 15% to 55%, contingent upon the individual’s income.

KoinX, a crypto tax firm, has reported that crypto taxes can be as high as 55% for individuals earning over 40 million Japanese yen ($268,000).

Comparatively, stock trading profits are subject to a maximum tax rate of 20%.

In the interim, corporate crypto holders must pay a uniform 30% tax rate on their holdings at the conclusion of the fiscal year, regardless of whether they have generated a profit through a sale.

A recent opinion survey conducted by the local news outlet Mainichi indicates that Tamaki’s DPP is unlikely to win the Japan election.

It is anticipated that the Liberal Democratic Party and its coalition partner Komeito will maintain a majority of the 465 seats, while the Democratic Progressive Party’s representation may increase from 7 to as many as 20 seats.