With the JPYUSD currency pair surging to 140.7, the highest in 2024, fears of Yen carry trade unwinding could spark a Bitcoin price drop.

The Japanese Yen has surged to its highest levels against the U.S. Dollar since January 2024, raising concerns about the potential unwinding of the Yen carry trade.

With the weakening of the USD/JPY currency pair, BitMEX CEO Arthur Hayes has already issued warnings.

The last time the Yen carry trade unwound, Bitcoin and global markets experienced significant downturns.

Currently, Bitcoin’s price has recovered after bouncing off the $54,000 level last weekend, but fears of a U.S. recession persist.

Impact of USD/JPY on Bitcoin Price

The recent strengthening of the Japanese Yen follows remarks by Bank of Japan board member Junko Nakagawa, who suggested that the central bank could continue adjusting its policies if the economy meets their projections.

As a result, the Yen gained 1.2%, reaching 140.71 against the U.S. Dollar, its strongest level since early 2024.

After hitting a low of 161.95 on July 3, the Yen has appreciated by more than 15% against the USD.

The weakening of the USD/JPY has heightened concerns over the potential unwinding of the Yen carry trade.

This trading strategy involves borrowing in low-interest currencies, like the Yen, and reinvesting in higher-yielding assets such as the USD.

However, with Japan’s interest rates rising, the Yen has become more attractive, possibly leading to a significant unwinding of carry trade positions.

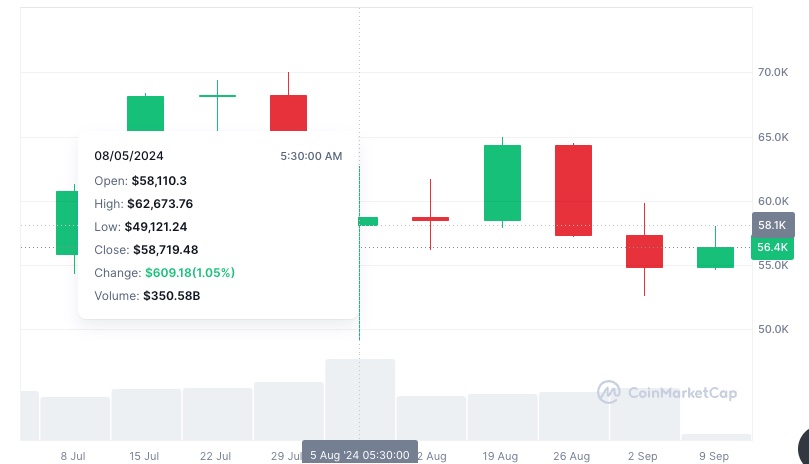

Such an unwinding could be risky for “risk-on” assets, like equities and cryptocurrencies. A similar event occurred on August 5, when Bitcoin’s price crashed from over $62,000 to $49,000 in one day.

Will Bitcoin Withstand the Yen Carry Trade Unwinding?

The crypto market is closely monitoring the potential impact of the Yen carry trade unwinding.

Arthur Hayes, co-founder of BitMEX, has cautioned about the performance of the USD/JPY pair, noting that its breakdown toward the 140 mark could signal increased volatility.

Hayes hinted at market turbulence, saying, “It’s about to be goblin town all over again in markets,” and questioned whether Bitcoin would hold up against the anticipated volatility.

Hayes had previously initiated a short position on Bitcoin under $50,000 but quickly closed it following the market’s recovery.

Analysts at the Bank of Japan expect the central bank to maintain steady interest rates at its upcoming meeting, although Nakagawa’s recent comments suggest a possible rate hike if economic and inflation conditions align with forecasts.

According to a Bloomberg report, Nakagawa’s optimistic stance on normalizing monetary policy has likely contributed to recent losses in dollar-buying positions.

Meanwhile, the U.S. Federal Reserve is considering its first rate cut next week, which could further reduce the interest rate gap between Japan and the U.S., making things worse for the USD.

Morgan Stanley’s Michael Wilson warned that U.S. equities could be at greater risk from the unwinding of Yen carry trades if the Fed delivers a significant 50-basis-point rate cut, which could encourage Japanese traders to pull out of U.S. assets, potentially leading to further market disruption.

Wilson noted, “The yen carry-trade unwind may still be a risk factor behind the scenes. A quick drop in US front-end rates could cause the yen to strengthen further, thus eliciting an adverse reaction in US risk assets.”