Banking giant JPMorgan has reportedly introduced an artificial intelligence (AI) tool which uses OpenAI’s ChatGPT to analyze Federal Reserve statements and speeches to identify potential trading signals.

Bloomberg reported on April 27 that a Wall Street investment bank employs a ChatGPT-based language model to analyze the comments of United States central bankers.

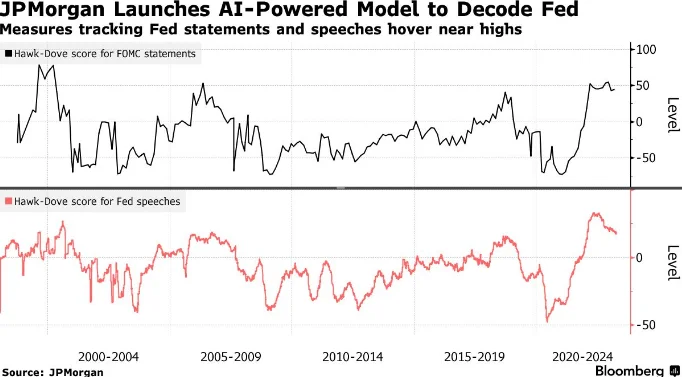

These Fed policy signals will be rated on a scale ranging from simple to restrictive to determine the bank’s so-called Hawk-Dove Score.

“Hawkish” is a monetary policy term for raising interest rates to control inflation. The opposite of “dovish” is “dovish,” which advocates for an expansionary monetary policy and reduced interest rates.

The AI tool will enable analysts to detect policy shifts, which could provide the bank with trading signals in advance. JPMorgan economist Joseph Lupton reportedly stated, “Preliminary applications are promising.”

The instrument can be used to forecast central bank tightening adjustments. For instance, hawkish policy statements could raise yields on one-year government bonds.

The JPMorgan model, which can analyze statements dating back 25 years, indicates that recent Fed sentiment has fluctuated but remains predominantly hawkish.

Bloomberg anticipates that the Federal Reserve will increase its benchmark interest rate by 25 basis points to 5.25 percent next week. A 10-point increase in the Hawk-Dove Score indicates a 10% probability that the next policy meeting will result in a rate hike and vice versa.

JPMorgan is interested in AI applications for its benefit but is hesitant to allow its employees to use them.

According to reports, the corporation prohibited its employees from using ChatGPT in February. No specific incident prompted the decision to restrict employee access to the AI chatbot, and other companies have taken similar measures.

In a letter to shareholders earlier this month, JPMorgan CEO Jamie Dimon disclosed that the bank had deployed more than 300 AI use cases.