The FOMC minutes for the month of June have been released, and the committee agreed to maintain interest rates for this month.

According to the FOMC minutes released to the public on Wednesday, July 5, the U.S. Federal Reserve voted unanimously to maintain the status quo for interest rates. The vast majority of primary dealers and market participants polled by the Open Market Desk anticipated no change in interest rates at this meeting.

Although the poll’s median route indicated no rate increases through the start of 2024, there was a wide range of responses. They believed subsequent discussions would likely result in an even more significant tightening.

Even though most members believe that additional rate increases are imminent, policymakers decided due to economic growth concerns. After ten consecutive rate hikes, they saw an opportunity to forego the June meeting, citing the policy lag effect and other considerations.

Two More Hikes Before the End of the Year?

The decision-makers reasoned that “leaving the target range unchanged at this meeting would allow them more time to assess the economy’s progress toward the Committee’s goals of maximum employment and price stability.”

Due to many factors, Federal Open Market Committee members expressed reluctance. They claimed that a brief halt would allow the Committee to evaluate the effects of the hikes, which comprised 5% points and were the most significant since the early 1980s.

Members of the FOMC also predicted that by the end of the year, two additional increases to the benchmark lending rate would likely be necessary to reduce inflation.

According to the revised Summary of Economic Projections published by the Federal Reserve, the current median forecast of FOMC members indicates that policymakers believe the federal funds rate will reach 5.6% by the end of the year, up from 5.1% in March.

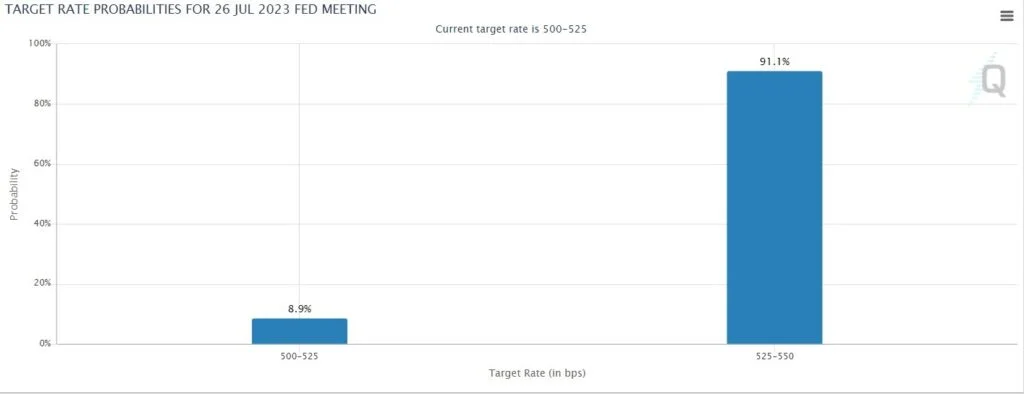

This suggests that the Fed may implement two additional quarter-point hikes during its final four meetings for the year. According to the CME FedWatch Tool, the probability of a quarter-point rate increase in July is 88.7% as of approximately 21 days before the next meeting.

Even though the U.S. economy has tolerated tighter monetary policy quite well, there are still concerns. Although inflation is the primary concern, several members are concerned about the state of the financial industry following three failures earlier this year. They stated that the sector’s downturn could lead to more stringent loan conditions.

Additional Obstacles for the Fed?

The American banking system is robust and trustworthy. Household and commercial credit restrictions are anticipated to affect employment, inflation, and economic growth. Unknown is the scope of these consequences. The Committee is nonetheless quite concerned about inflationary hazards.

The Committee’s long-term objective is to achieve full employment and inflation of 2%. To further these objectives, the Committee maintained the target range for the federal funds rate at 5 to 5-14%. This meeting’s target range allows the Committee to evaluate new data and its impact on monetary policy.

The Effects Of The FOMC Minutes Publication

The combination of higher U.S. Treasury yields, a stronger currency, and the hawkish tone conveyed in yesterday’s minutes put downward pressure on gold prices. August’s most active gold futures contract ended the most recent trading session down $6.80, at $1922.70.

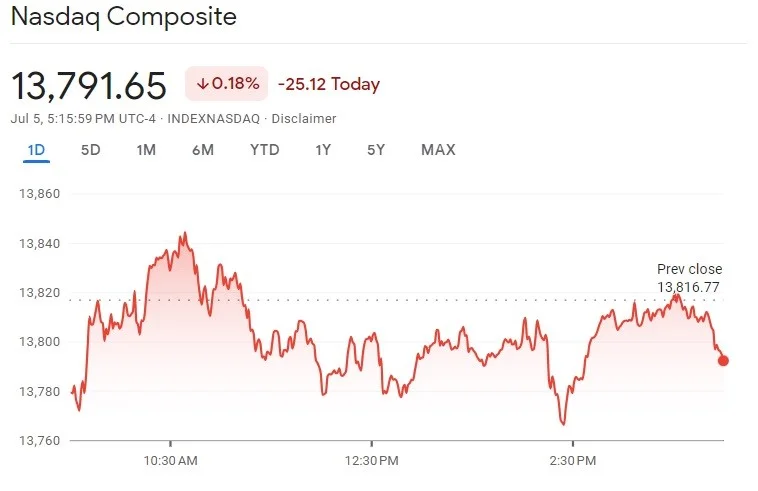

In addition, as investors analyzed the minutes from the Fed’s most recent meeting and prepared for crucial economic data in the coming days, Wall Street’s main indexes ended Wednesday with modest losses.

This week, the release of job openings data on Thursday and the release of the official June employment report are two crucial data points for the United States, and much depends on them.