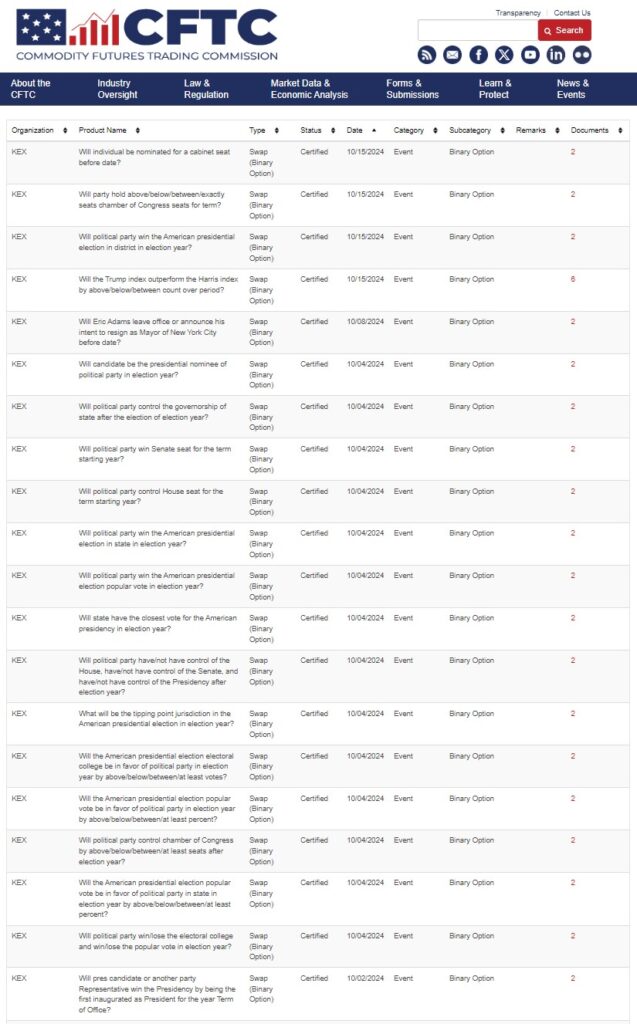

Kalshi certified event contracts for U.S. political events after a legal win against the CFTC in September.

Kalshi has certified more than a dozen event contracts that are related to the results of political events in the United States since he prevailed in a major court battle in September.

These event contracts, also known as binary options, are the first in the United States to enable traders to place bets on election results. They discuss a wide range of topics, including the presidential election in the United States that will take place in November, Senate contests, cabinet nominations, and even the possibility of resignation from New York City Mayor Eric Adams.

As of the 16th of October, the flagship market of Kalshi, titled “Who will win the presidential election?” has generated a total betting volume of $14 million since it was listed on the 7th of October, as stated on the Kalshi website.

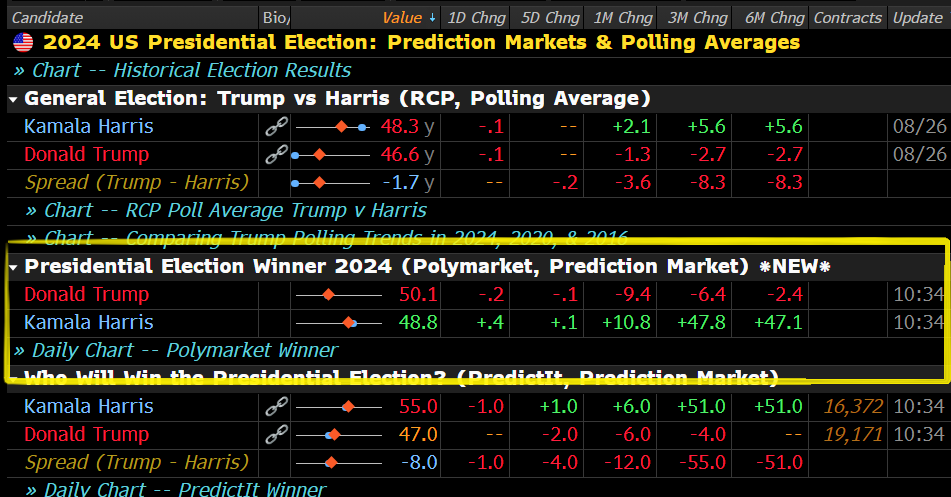

In comparison to Polymarket, a decentralized prediction marketplace that operates on the Polygon network, Kalshi, which is a US-regulated exchange, is still a significant distance behind. According to its website, Polymarket has enabled customers to place wagers totaling roughly $2 billion on the presidential election in the United States.Polymarket, a permissionless forum for betting on US election outcomes, rose to prominence in 2024 following its initial launch in 2020.

In November of 2023, Kalshi filed a lawsuit against the Commodity Futures Trading Commission (CFTC), which is the regulatory body for derivatives in the United States, for attempting to prevent the exchange from listing contracts for political events. In September, a court verdict declared Kalshi victorious, and on October 2, a federal appeals court upheld his victory.

Election prediction markets like Kalshi, according to the Commodity Futures Trading Commission (CFTC), pose a threat to the integrity of elections; yet, observers in the business believe that they frequently represent public emotion more correctly than polls.

Harry Crane, a statistics professor at Rutgers University, stated in a comment letter to the Commodity Futures Trading Commission (CFTC) in August that “Event contract markets are a valuable public good for which there is no evidence of significant manipulation or widespread use for any nefarious purposes that the Commission alleges.

During the month of August, the financial data and news service known as Bloomberg LP included the election chances data provided by Polymarket in its terminal. When it comes to institutional financial data platforms, Bloomberg Terminal is the most widely used in the world.

Wall Street Prep estimates that it holds approximately one-third of the market share for services related to financial data. According to Kalshi, the odds of Republican nominee Donald Trump winning the election are 55% as of October 16th, while those of Kamala Harris, the Democratic candidate, are 45%.

Bettors on Polymarket are even more optimistic about Trump, putting his odds at 58%, significantly higher than Harris’s odds, which are less than 41%. In addition, Polymarket takes into account possibilities with a low likelihood, such as the victory of a third-party candidate in November.