Kraken’s CEO Jesse Powell announced that the exchange’s global headquarters located in San Francisco has been closed due to insecurity experienced by members of staff in the area.

Jesse Powell, the CEO of Kraken, announced on Twitter that the company’s global headquarters at 548 Market Street in San Francisco will close. Richie Greenberg, a political commentator in San Francisco, retweeted the decision, which states:

“We shut down Kraken’s global headquarters on Market Street in San Francisco after numerous employees were attacked, harassed and robbed on their way to and from the office.”

The tweet also claims that “San Francisco is not safe” and that crime is “dramatically underreported,” which is poor marketing for residing in California’s financial centre.

The Twitter community reacted quickly to the Kraken news, sharing grim memories from their time working in San Francisco.

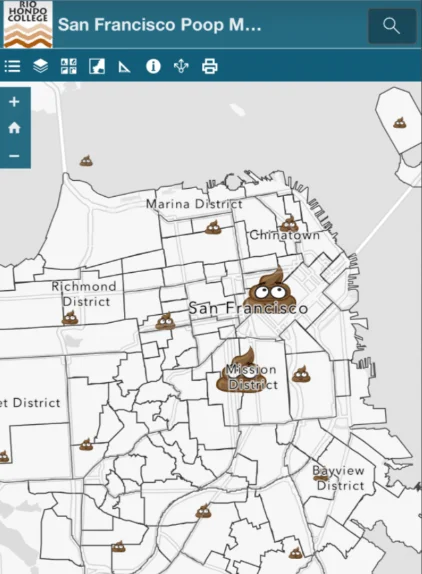

The living situation is so bad that there are apps that track human trash in San Francisco; one of the most popular is Snap Crap. The apps assist San Franciscans in navigating the city without stepping into it.

The community comments on Twitter and Reddit highlighted how rising rental prices have made homelessness more widespread, while violence is “rampant.” The average rent in San Francisco is currently above $3,000 per month, and the San Francisco Chronicle estimates that the city has over 18,000 homeless people.

San Francisco and crypto

According to a survey published in 2020, San Francisco and the Bay Area have the biggest concentrations of crypto assets. The grasp on crypto and the future of finance may falter in light of Kraken’s decision and the social issues in San Francisco.

Other US towns and states have made it apparent that they want to attract crypto capital: Texas, for example, is home to pro-Bitcoin Senator Ted Cruz (BTC), and the mayor of Austin has praised Web3 and crypto payments.

Coinbase, a cryptocurrency exchange established in the United States, will close its San Francisco headquarters in 2022 as well, with no mention of crime or homelessness. Coinbase, on the other hand, followed its competitor Binance’s lead in becoming a fully remote, worldwide corporation.