Bitcoin (BTC) the king of all cryptocurrencies has dropped by another 8% falling below $31,000 for the first time since July 2021.

BTC whales have been depositing enormous amounts of Bitcoin on exchanges, according to on-chain data. According to CryptoQuant, BTC inflows across all exchanges have reached a one-year high. Similarly, the spot market inflows have reached a two-year high.

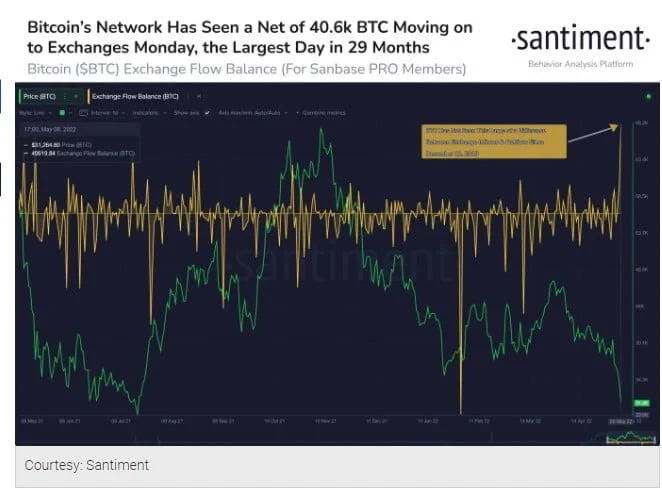

According to Santiment’s on-chain data, over 40K Bitcoins were transferred to the exchanges on Monday, the greatest single-day inflow since December 2019. Santiment observes:

“As Monday has crossed into its final trading hour (UTC time), a landmark in net Bitcoin moving to exchanges has occurred. Today’s net sum of ~40,620 $BTC in exchange inflow is the largest spike since Dec, 2019. This marks maximal crowd polarization”.

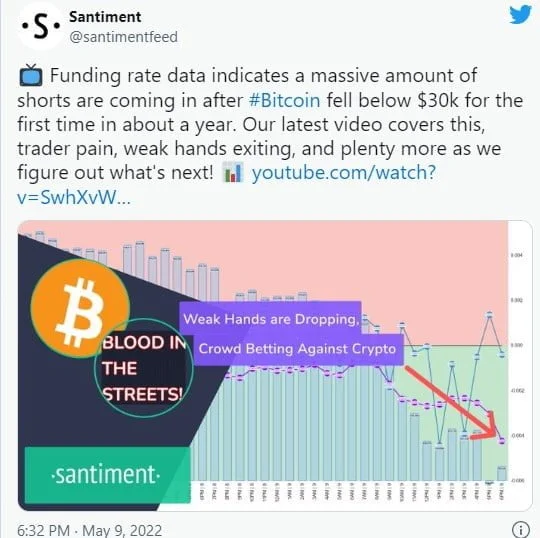

Large Bitcoin Shorts Trooping In

Santiment, the on-chain data provider reports that “Funding rate data indicates a massive amount of shorts are coming in after BTC fell below $30k for the first time in about a year.”

It indicates the chaos on the crypto street isn’t going away anytime soon, and investors are due for more misery. The US equities market, on the other hand, shows no indications of reversal and continues to fall.

The Nasdaq Composite (INDEXNASDAQ:.IXIC) was down 4.29% dropping more than 500 points in one day. On Monday, Dow Jones fell 2% and the S&P 500 fell 3.2%.

The larger cryptocurrency market is currently down 10% and currently at $1.4 trillion as of the time of writing. With all of the controversy surrounding the UST stablecoin losing its dollar peg, Terra’s LUNA remains the biggest loser.

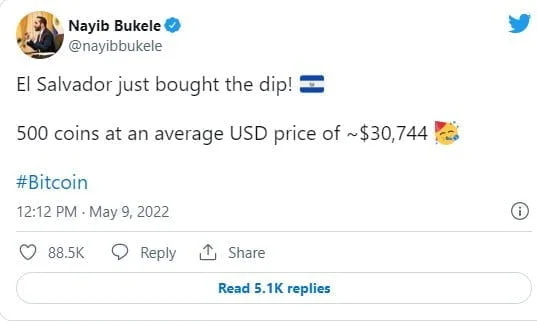

However, during this market downturn, El Salvador reported its largest-ever one-time Bitcoin purchase. The Latin American country invested $15,372,000 in 500 Bitcoins.

El Salvador now has over 2,300 Bitcoin in its possession due to its recent purchase.