In its final report on digital assets, the Law Commission of England and Wales encouraged the government to classify all crypto assets as a new form of personal property.

The Law Commission is an independent entity predominantly responsible for reviewing and recommending law reforms in England and Wales. It issued a supplemental report on July 30 that underscored the legal implications of the current personal property classification and its inadequacy with crypto assets.

The demand for a novel form of personal property

English law divides personal property into two primary categories: tangible property (things in possession) and intangible property (things in action, such as debts or rights). The Commission contended that digital assets, such as cryptocurrencies and non-fungible tokens, can exhibit both qualities and impede dispute resolution in judicial proceedings.

Consequently, it suggested the establishment of a “third category” to guarantee that property rights associated with crypto assets are both enforceable and transparent:

“We conclude that the flexibility of common law allows for the recognition of a distinct category of personal property that can better recognize, accommodate, and protect the unique features of certain digital assets (including crypto-tokens and crypto assets).”

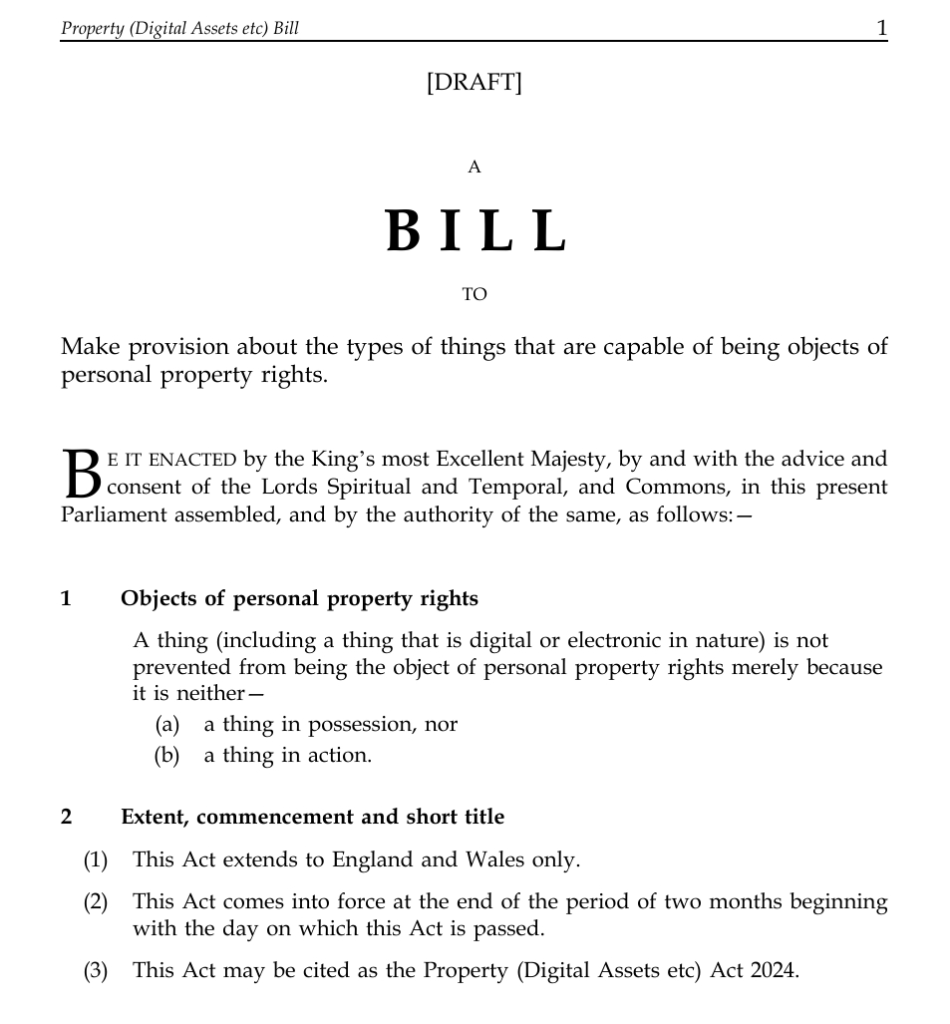

To facilitate the expansion of the digital assets sector in England and Wales and establish a robust legal framework, the Commission published a draft bill that calls for establishing a distinct category for crypto assets.

England and Wales regulators to evaluate the draft law

The draft law defers to the courts the responsibility of establishing the third category for crypto assets, which could be modified without disrupting the legal proceedings of other forms of personal property.

The Commission stated that the government is reviewing the draft legislation and the recommendation.

The Financial Conduct Authority, the UK’s financial regulator, and the Bank of England recently released a consultation regarding the proposed guidance for their Digital Securities Sandbox.

The sandbox is intended to enable participants to evaluate distributed ledger technology for trading and settlement of digital securities, including shares and bonds, following the joint consultation and draft guidance released on April 3.