XRP lawsuit: Pro-XRP lawyer Jeremy Hogan predicts a likely timeline for the Ripple SEC case in the wake of US SEC Chair Gary Gensler’s exit.

The announcement of US SEC Chair Gary Gensler’s departure has boosted sentiment across the crypto market, sparking hopes of a more pro-crypto regulator taking his place.

This development has also fueled discussions around the ongoing SEC lawsuits, with many market observers predicting that they may conclude or settle following Gensler’s exit.

Pro-XRP lawyer Jeremy Hogan has contributed to these discussions by offering a potential timeline for the conclusion of the Ripple SEC lawsuit.

Lawyer Predicts Potential XRP Lawsuit Conclusion Timeline

The SEC recently confirmed that Gary Gensler will leave his post in January 2025, which has generated significant interest in the financial markets, particularly within the crypto space.

Gensler is often viewed as an anti-crypto figure, and many believe his leadership has hindered innovation in the digital asset sector.

Amidst this, there’s growing speculation that the SEC’s ongoing cases, including the Ripple lawsuit, may settle or be resolved once a new Chair is appointed.

Pro-XRP attorney Jeremy Hogan sparked further discussion when he shared Gensler’s exit news on X and was asked how long it might take for the Ripple case to be concluded.

Hogan replied, predicting that the Ripple vs. SEC case could wrap up by spring or early summer of 2025. He stated:

“I still think we are looking at spring next year – maybe early summer.”

This comment has sparked renewed interest, especially as the Ripple case is one of the longest-running crypto lawsuits, recently extended with the SEC’s appeal.

XRP’s Prospects for a Rally Amid Positive Developments

Hogan also highlighted positive news for XRP in a separate X post, including the launch of the WisdomTree Physical XRP ETP on Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam.

This development has reignited speculation about a potential XRP ETF launch in the US, with firms like Bitwise and Canary Capital awaiting approval from the SEC.

Hogan has previously suggested that an XRP ETF could be launched in the US within 6 to 12 months, adding to the market’s optimism.

Supporting this sentiment, renowned lawyer John Deaton predicted that XRP’s market cap could soon reach $100 billion, citing the recent shift in the US administration.

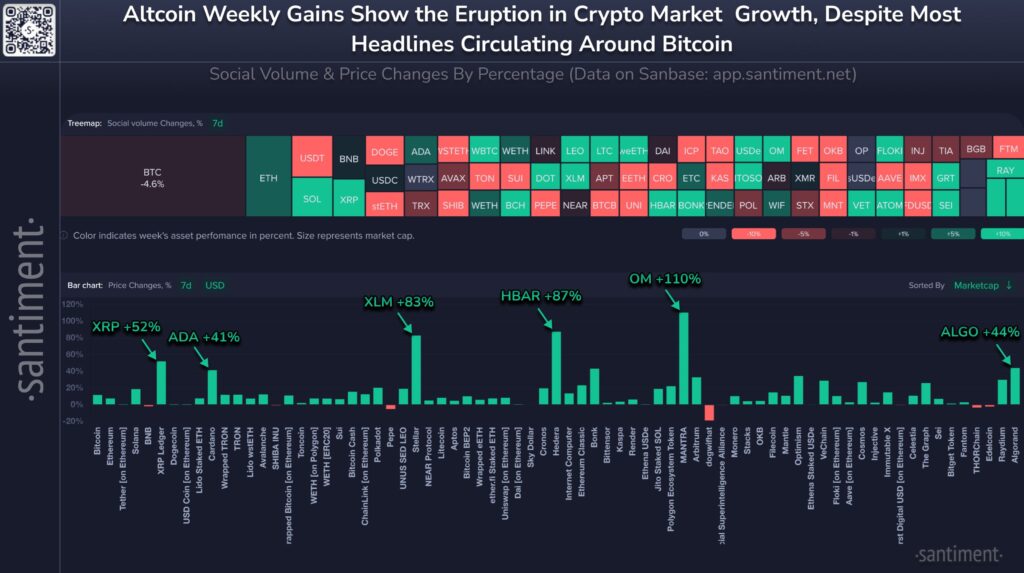

Additionally, the bullish rally in Bitcoin has further fueled market optimism, suggesting that top altcoins, including XRP, might follow suit.

XRP Price Soars, Fueling Bullish Sentiment

XRP’s price surged by nearly 27%, reaching $1.43, with its trading volume spiking 235% to $22.29 billion, reflecting increased market activity.

CoinGlass data also showed a 31% rise in XRP Future Open Interest, signaling growing investor confidence. The positive outlook for the XRP lawsuit’s conclusion has likely contributed to this uptick in sentiment.

Top crypto analyst CrediBULL Crypto noted that XRP’s monthly Relative Strength Index (RSI) has entered the “overbought” zone for the first time in three years, signaling strong bullish momentum. The analyst has set a short-term target of $2 for XRP, with a long-term forecast of $3.3.

Similarly, market expert Ali Martinez shared a similar outlook, describing Gary Gensler’s exit as the “best thing that could happen to Ripple.” Martinez also set a $2 target for XRP, further boosting optimism within the market.