Ledger, a prominent hardware cryptocurrency wallet provider, is enhancing its app’s purchasing capabilities by forming a new partnership with Uphold’s Topper.

The United States Web3 financial platform Uphold has developed the fiat-to-crypto on-ramp Topper, which Ledger has integrated, the companies announced on September 26.

The integration introduces a new cryptocurrency purchasing option to Ledger Live, the company’s software. According to Jean-François Rochet, Ledger’s vice president of international development, the application presently includes 14 providers that provide on-ramp services through the Buy section. Cointelegraph reported on this.

“While some partners prioritize localized solutions, others adopt a global perspective,” Rochet observed that this results in a well-balanced combination of local and global offerings for our users.

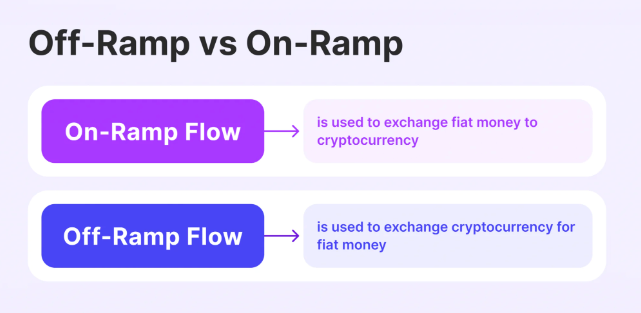

Ledger has a single off-ramp solution and 14 on-ramps.

Crypto on-ramps and off-ramps convert fiat money into cryptocurrencies such as Bitcoin and vice versa, connecting the crypto market to the conventional financial system.

For instance, users can acquire Bitcoin using a fiat currency such as the US dollar and store it directly on the Ledger’s hardware wallet by implementing Topper’s on-ramp solution on Ledger Live.

Rochet asserts that Ledger’s interface offers substantially fewer off-ramp solutions than on-ramp solutions. Consequently, users have a greater number of options for purchasing cryptocurrency than for selling it.

Rochet informed Cointelegraph on September 25 that they are onboarding additional partners to broaden their geographical, fiat, and crypto coverage. Currently, they have one partner that provides off-ramp services.

The executive stated that the limited availability of off-ramp options on Ledger resulted from the intricacy of off-ramp integrations. He noted that such implementations “require signing transactions on the device using clear signing capabilities.”

Rochet stated that in 2020, Ledger incorporated its initial on-ramp and off-ramp partner, Coinify.

Topper to introduce an off-ramp in Q4 2024

Robin O’Connell, CEO of Topper at Uphold Enterprise, disclosed to Cointelegraph that the platform has expanded its support to 228 crypto assets and has integrated with 36 networks since its inception in 2023.

O’Connell anticipates that Topper will introduce the off-ramp in the fourth quarter of 2024 and make it accessible to its partners as soon as they can incorporate it into their roadmaps.

“Topper currently supports 150 countries,” the executive stated. He also mentioned that the platform incorporates new local payment methods to serve countries with high crypto adoption rates better.

One such implementation was the integration of Topper with Pix in July 2024, the bank transfer system introduced by the Central Bank of Brazil.

Ledger and Topper’s approach to KYC

By default, Ledger’s hardware wallet does not necessitate KYC identification for transactions, as it is a self-custodial storage solution. However, providers such as Topper must conduct KYC checks for on-ramp and off-ramp transactions, and Ledger does not have access to this data.

O’Connell stated, “Our objective is to ensure that the onboarding process is as effortless and efficient as possible for the user.”

“Our goal is to increase crypto adoption and provide ease of access while performing our due diligence to validate users. Our KYC process is quick and our transaction approval rating is the highest amongst other onramp providers.”

Although Ledger does not necessitate KYC verification, the wallet operates identity verification on its private key recovery utility, Ledger Recover.

Ledger stated on its FAQ page that “identity verification inherently collects much less information than KYC.” It also noted that Ledger Recover’s ID verification necessitates only a valid government-issued document.

On the other hand, KYC checks on other platforms typically involve ID verification, but they can also include revenue information, records of criminal activity, citizenship checks, and other details.