Lower interest rates and increasing crypto adoption are encouraging more financial institutions to embrace Bitcoin-backed lending.

Financial institutions are increasingly entering the Bitcoin-backed lending space as Bitcoin adoption continues to grow among investment managers, while fiat interest rates become more restrictive, according to a statement by Bitcoin-backed lending platform Ledn to Cointelegraph on Sept. 25.

Institutional investors have invested billions into spot Bitcoin exchange-traded funds (ETFs) following approval by U.S. regulators for trading in January. Ledn noted that “[M]ajor institutions are now going beyond ETFs to focus on Bitcoin-backed lending.”

Ledn revealed that it processed $1.16 billion in cryptocurrency loans during the first half of 2024, primarily for financial institutions.

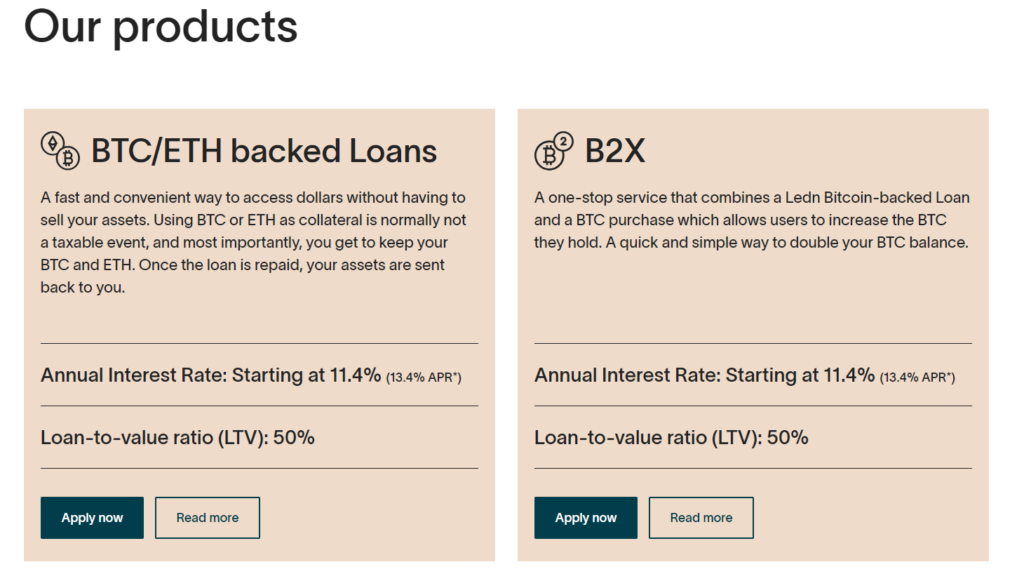

These lenders typically earn over 10% annual returns (APR). Borrowers face interest rates between 11.4% and 13.4%, depending on the loan type, according to Ledn’s website.

Ledn’s model involves lending out Bitcoin collateral to generate additional yield, though this introduces credit risk for borrowers, the company explained on its site.

On Sept. 18, the U.S. central bank reduced interest rates on short-term Dollar deposits from around 5.3% to 4.8%, according to the Federal Reserve Bank of New York.

Bitcoin-backed loans are denominated in fiat currency and secured with Bitcoin, which the borrower forfeits if the loan is not repaid.

The market for Bitcoin-backed loans is currently valued at approximately $8.5 billion and is expected to grow to $45 billion by 2030, according to market researcher HFT Market Intelligence.

Ledn competes with other Bitcoin platforms such as Arch and Salt and will soon face competition from established financial firms like Cantor Fitzgerald, which announced plans to launch its own institutional Bitcoin financing platform in July.

Ledn also indirectly competes with decentralized finance (DeFi) lending platforms like Aave. The Bitcoin-backed lending market has benefited from the increasing number of regulated U.S. cryptocurrency custodians that hold Bitcoin on behalf of investors.

In August, Cointelegraph reported that Fireblocks, known for its self-custody treasury management tools, received approval from New York’s financial regulator to provide asset custody services for U.S. clients.

Other major institutional crypto companies, including Coinbase Custody Trust, Fidelity Digital Asset Services, and PayPal Digital, also hold similar licenses.