The new fund will support startups working on blockchain-based solutions, such as zero-knowledge infrastructure and new Bitcoin ecosystems.

Venture capital firm Lemniscap has announced the launch of a new fund to support early-stage Web3 startups.

As per the announcement on August 28, the fund will have $70 million to invest in various blockchain-based businesses.

These include areas like zero-knowledge infrastructure, consumer applications, emerging Bitcoin ecosystems, security, and decentralized physical infrastructure (DePIN).

This new fund is supported by Accolade Partners, a fund of funds that also focuses on early-stage ventures in the blockchain space.

Lemniscap has a reputation for investing in early-stage crypto startups. The firm introduced its first fund in 2017, just before the 2018 crypto market downturn.

Since its inception, Lemniscap has invested in several notable protocols in the industry, including Avalanche, Fairblock, Celestia, EigenLayer, Euler, ParaSwap, and Axelar, among others.

So far, the firm has made over 130 investments in the Web3 sector.

Lemniscap’s investment strategy emphasizes “long-term success rather than short-term gains,” concentrating on products and services that leverage blockchain technology.

The firm supports startups in its portfolio not only with financial investments but also with strategic guidance.

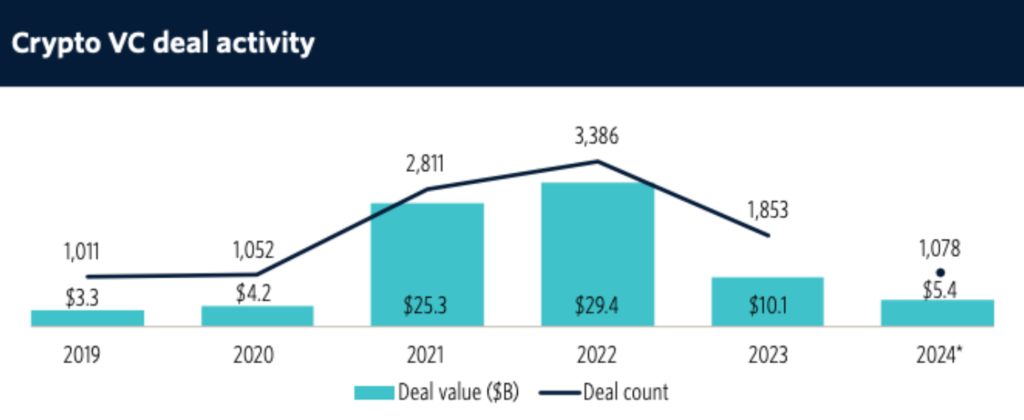

The Web3 startup ecosystem has experienced a revival in 2024, following a challenging year marked by bankruptcies, regulatory uncertainties, and a decline in crypto token prices.

According to Pitchbook, crypto startups raised $2.7 billion in the second quarter of this year, with infrastructure projects like Monad and BeraChain leading the way.

Despite this recovery in funds raised, the total number of deals has decreased by 12.5%, suggesting that while investors are more discerning, they are making larger commitments to projects with significant potential.

In 2023, crypto firms secured a total of $10.1 billion in investments.

Based on current industry trends, Pitchbook anticipates that startup funding could exceed this amount in 2024, potentially reaching $10.8 billion by the end of the year.