A nonfungible token (NFT) collector described how a decentralized finance (DeFi) loan was secured by a luxury watch and facilitated by a nonfungible token (NFT) representing the asset.

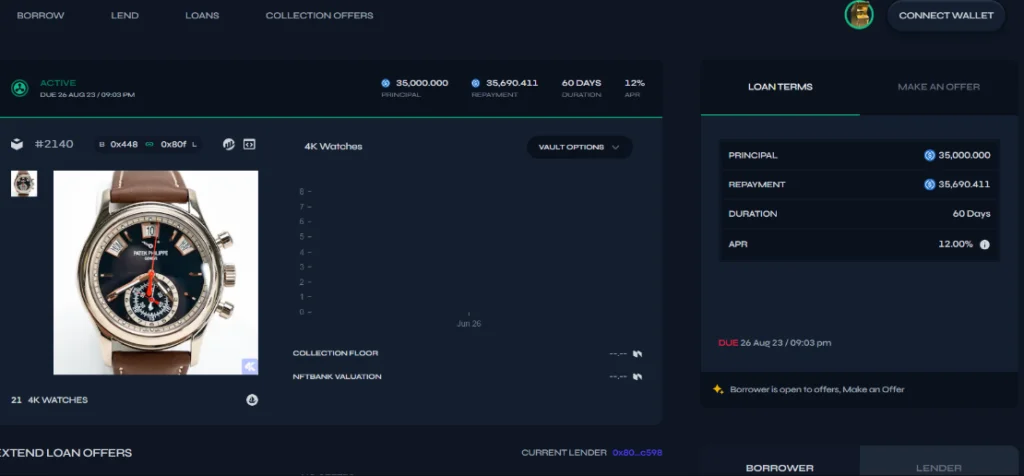

On July 11, fictitious DeFi project advisor CirrusNFT described how a user could borrow $35,000 from another user using an NFT representing a tangible item as collateral.

According to the executive, a user reportedly sent a Patek Phillipe luxury watch to 4K Protocol, an escrow company that handles NFTs backed by tangible items. The company then returned an NFT representing the watch’s ownership.

The NFT was then included in DeFi’s Arcade lending protocol. The lenders presented their offers to the borrower after listing the item. The user then accepted the finest available loan offer.

The NFT was then sent to an escrow device, remaining until the loan is fully repaid or the borrower defaults. If the borrower fails to repay the loan, the lender will receive the NFT. The card can then be burned to recover the watch.

CirrusNFT explained that this method allows users to lend and borrow without revealing their identities. There is no requirement for lenders and borrowers to submit their identities to each other to complete the process.

In addition, the executive believes this provides individuals greater access to global liquidity, which may result in more competitive interest rates.

A community member tweeted that their father found the Web3 lending process “interesting.”

Others believe that the new method of lending and borrowing is excessively centralized and adds NFTs where they are unnecessary.