MakerDAO wants to make money with its stablecoin, DAI, by investing in traditional assets like US treasuries and maybe even corporate bonds.

MakerDAO is now voting on a plan to invest 500 million Dai stablecoins in a mix of US treasuries and bonds to help it weather the bear market and utilize untapped reserves.

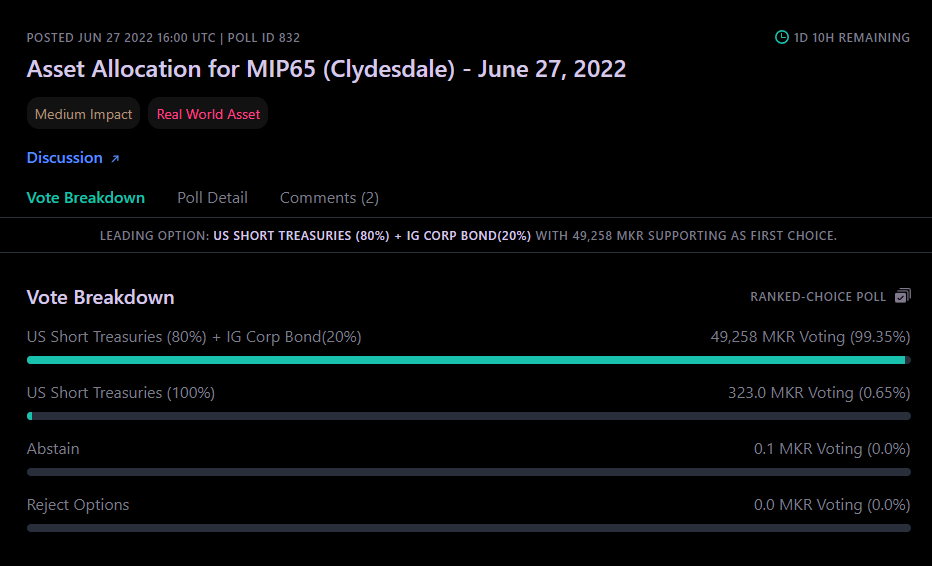

Following a straw vote in a governance ‘Signal Request,’ members of the decentralized autonomous organization (DAO) must now determine whether the dormant DAI should be invested wholly in short-term treasuries or split 80 percent in treasuries and 20 percent in corporate bonds.

MakerDAO is the governing body of the Maker system, which generates Dai stablecoins tied to the US dollar in exchange for user deposits of Ether (ETH), Wrapped Bitcoin (WBTC), and approximately 30 other cryptocurrencies.

This plan is a significant step forward for Maker DAO, signaling its intention to go beyond the crypto sphere and generate a yield from traditional “safe” financial assets through its flagship DAI.

MakerDAO lets users vote on projects by staking their MKR. So far, the option to split Dai into treasuries and bonds has 99.3 percent Maker (MKR) token support, even though only 12 voters have voted. Maker’s governance participation is currently at its lowest point in 2022, with 169,196 MKR tokens staked.

The poll closes on June 30 at noon ET, giving other voters only a few hours to choose a side, abstain, or reject the selections.

Once a solution has been selected, European wholesale lender Monetalis will grant MakerDAO access to the financial instruments it desires. Monetalis CEO Allan Pedersen posted the Signal Request on the forum, outlining the choices that his company may offer the DAO.

According to the UN definition, the company’s purpose is to shift to low carbon resource efficiency.

The DAO’s decision to invest such a significant sum is based on recommendations from various members who feel that deploying the unused assets might assist increase the protocol’s bottom line while posing a little risk.

Sebastien Derivaux, a member of MakerDAO’s Strategic Finance Core Unit, stated in a June 20 review of the allocation’s feasibility that, while the amount in question appears very high, it should be a safe choice for the DAO.

“An investment of 500M DAI in this context, that is expected to remain liquid and low volatility, is therefore not a significant risk for the DAI peg nor the solvency of MakerDAO.”

Derivaux claimed that the two solutions currently being voted on were the best of the five possibilities on the table.

Despite the historic gain, MKR is down 1.6 percent in the last 24 hours and trading at $964.71, according to CoinGecko.