On November 27, MARA raised $1 billion through a convertible note to acquire 6,474 Bitcoin, including 5,771 at an average price of $95,395.

Mining business MARA, which was formerly known as Marathon Digital, provided investors with an update on November 27. The update detailed the company’s recent 0% $1 billion convertible note offering, which resulted in the acquisition of 6,474 Bitcoin.

In addition to the initial acquisition of 5,771 Bitcoins at an average price of $95,395 per coin, the corporation reportedly purchased an additional 703 Bitcoins, as stated in the release.

Each share of MARA’s Bitcoin has generated a yield of 36.7% so far this year, and the company’s treasury currently has approximately 34,797 Bitcoins with a value of approximately $3.3 billion among them. Furthermore, MARA has acquired a portion of its 2026 notes for a sum of $200 million.

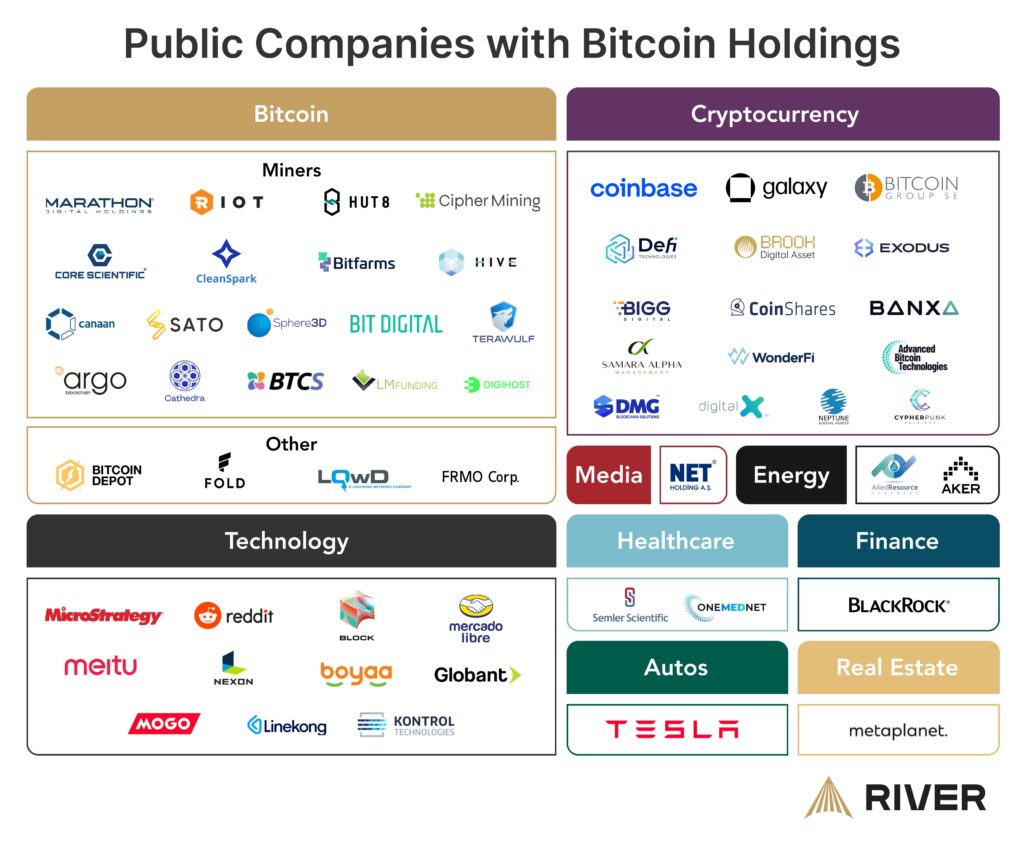

Additionally, MARA will use the approximately 160 million dollars left over from the convertible debt raise to purchase additional Bitcoin at more favorable prices during periods of price declines. The mining business has emulated MicroStrategy by selling convertible debt worth one billion dollars, a strategy that involves issuing corporate debt to purchase more Bitcoin.

This is a technique that is gaining appeal among corporate institutions. The year 2020 marks the beginning of MicroStrategy’s acquisition of Bitcoin. The corporation’s most recent debt raising was a senior convertible note issue with a face value of $3 billion and no interest.

The capital raise is a component of the ambitious 21/21 strategy that the firm has devised to acquire $42 billion in cash over the course of the next three years in order to improve its balance sheet and purchase additional Bitcoin.

On November 21, 2024, the price of Microstrategy’s shares dropped by around 25 percent, despite the fact that the firm had a plan to purchase Bitcoin through the use of debt denominated in fiat currency and that investor interest in the company had increased.

The corporation acquired approximately 55,000 Bitcoins between November 18 and November 24, with an average purchase price of approximately $97,862 per transaction. This brings the total amount of Bitcoin that MicroStrategy possesses to around 386,700 BTC, making it one of the top holders of Bitcoin.

On the other hand, critics of MicroStrategy argue that the acquisition of Bitcoin through debt financing is a strategy that is both hazardous and unsustainable. Some have questioned whether MicroStrategy is in a bubble as a result.

If there is a significant drop in the price of Bitcoin, MicroStrategy may find itself in a difficult financial situation. However, the firm will not be required to make any repayments until the year 2028. This should provide the company a significant amount of time to recover from any short-term market downturns.