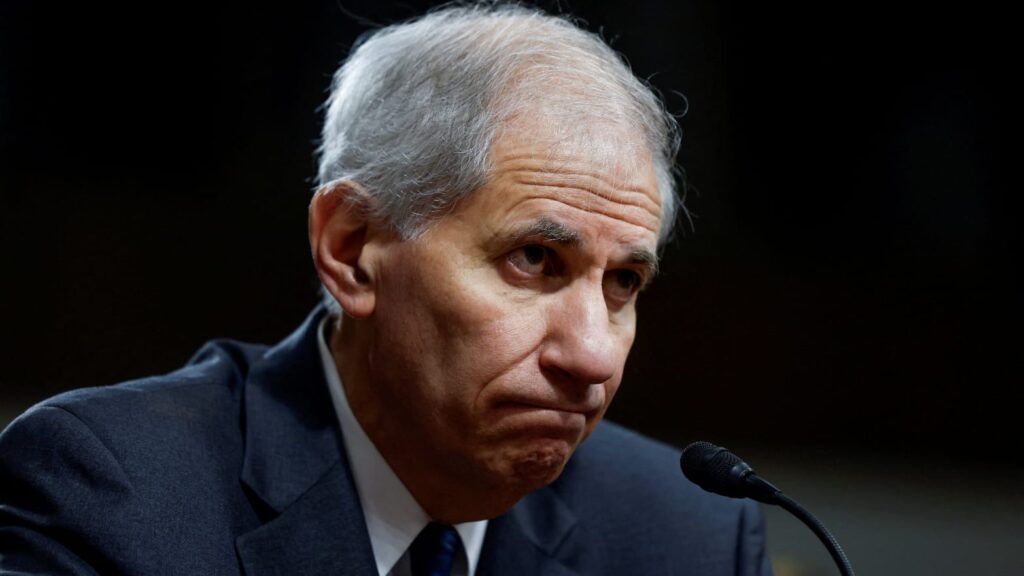

Republicans and Democrats have criticized Martin Gruenberg since an independent investigation uncovered various workplace issues at the FDIC.

Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation (FDIC) of the United States, will resign in the wake of a damning investigation that exposed the bank regulator’s poisonous corporate culture.

Martin Gruenberg announced his intention to resign as chairman of the FDIC, an organization he has presided over since August 2005, on May 20.

“In light of recent events, I am prepared to step down from my responsibilities once a successor is confirmed,” he said in an email to staff before adding, “ he wrote in an email to staff. “Until that time, I will continue to fulfill my responsibilities as Chairman of the FDIC, including the transformation of the FDIC’s workplace culture.”

The FDIC is an autonomous governmental agency in the United States that provides insurance coverage to depositors of commercial and savings institutions.

The announcement is in response to a third-party investigation into allegations of sexual harassment and other interpersonal misconduct at the FDIC, which was published on May 7. The investigation also detailed the management’s reaction to the misconduct.

Gruenberg testified before Congress on May 15 regarding allegations of pervasive sexual harassment and maltreatment of subordinates. Republicans and Democrats criticized him, expressing wrath, dismay, and disbelief at the magnitude of the problems at the FDIC, as reported by Reuters.

Legislators have demanded his resignation, and Senate Banking Committee Chair Sherrod Brown urged Vice President Biden to appoint Gruenberg’s successor.

The White House has declared its intention to submit a fresh candidate for the position of FDIC chair. Senator Elizabeth Warren, on the other hand, expressed confidence in Gruenberg’s capacity to implement transformation within the agency.

The cryptocurrency community has praised the development, with Nic Carter, a partner at Castle Island Ventures, remarking that it was “the best day ever.”

Meanwhile, attorney John Deaton of the digital asset industry commented:

“It is shameful how Elizabeth Warren circled the wagons to keep one of her disgraced puppets in place. I’m so looking forward to the debates.”

Nic Carter devised Operation Choke Point 2.0 in 2023 to describe a coordinated effort by the FDIC to dissuade banks from holding crypto deposits or providing banking services to crypto firms. It is believed that Gruenberg was instrumental in facilitating this effort.

Gruenberg drew a parallel between crypto assets and the precarious financial innovations that precipitated the 2008 financial crisis, including subprime mortgages and collateralized debt obligations, during a speech in October 2022.