The Monetary Authority of Singapore (MAS) has granted a full major payment institution (MPI) license to the cryptocurrency trading business and liquidity provider GSR Markets.

According to reports, GSR obtained the license on April 4, following in-principle approval in October 2023. According to Xin Song, CEO of GSR Singapore, GSR is the first company in the nation to be granted an MPI license.

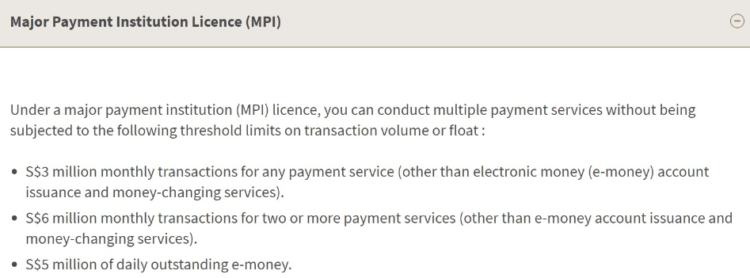

Companies in Singapore with MPI licenses can offer more than one payment service and surpass payment firms’ volume restrictions.

The volume limit for a payment service is 3 million Singapore dollars ($2.2 million), while the monthly maximum for two or more payment services is 6 million Singapore dollars ($4.4 million) for licensed enterprises.

Concerning GSR, the license would enable the business to carry out its market-making and over-the-counter (OTC) spot operations under the supervision of Singapore’s central bank.

Founded in 2013, the company offers OTC cryptocurrency trading, derivatives, market making, and venture capital investment services. Additionally, it possesses business licenses for money service in several US jurisdictions.

Financial institutions can investigate blockchain-based technologies in Singapore because of legal measures that aim to establish the nation as a hub for digital assets.

Consequently, many cryptocurrency businesses aiming to serve the area have raced to obtain the MPI license to provide their services there.

Crypto.com, Coinbase, and Ripple got official permission for their MPI licenses in Singapore in 2023. September saw the official approval of Coinbase and Ripple, while June saw the license for Crypto.com.

Singaporean authorities granted in-principle approval for the MPI license to cryptocurrency exchange OKX and custodian BitGo in 2024. BitGo got the go-ahead first in January, while OKX got the go-ahead first in March.

Singapore is encouraging innovation in cryptocurrency but is also tightening its legal framework and clamping down on retail speculation.

Following comments on its proposed digital payment tokens (DPTs) laws, MAS established policies to discourage ordinary investors from engaging in cryptocurrency speculation.

The MAS released a list of five strategies on November 24 for DPT service providers to dissuade retail consumers from price speculating.

Singapore’s central bank recently extended the Payment Services Act’s jurisdiction. MAS said on April 2 that it had placed several initiatives under the purview of the Payment Services Act.

This covers DPT custodial services, token exchange and transfer facilitation, and cross-border fund transfers.