Mastercard collaborates with Mercuryo to develop a euro-denominated crypto debit card, allowing customers to spend crypto from self-custodial wallets at over 100 million merchants.

Global payment giant Mastercard is broadening its support for non-custodial cryptocurrency wallets through a new collaboration to allow users to spend crypto while “being their own bank.”

After launching a crypto debit card in partnership with the self-custodial wallet MetaMask in August, Mastercard is now teaming up with European crypto payments infrastructure provider Mercuryo to bridge traditional finance and cryptocurrency further.

In this collaboration, Mastercard has introduced a euro-denominated debit card that enables users to spend cryptocurrencies, such as Bitcoin, stored on self-custodial wallets at more than 100 million merchants within the Mastercard network.

Mastercard’s Mission to Promote Crypto Self-Custody

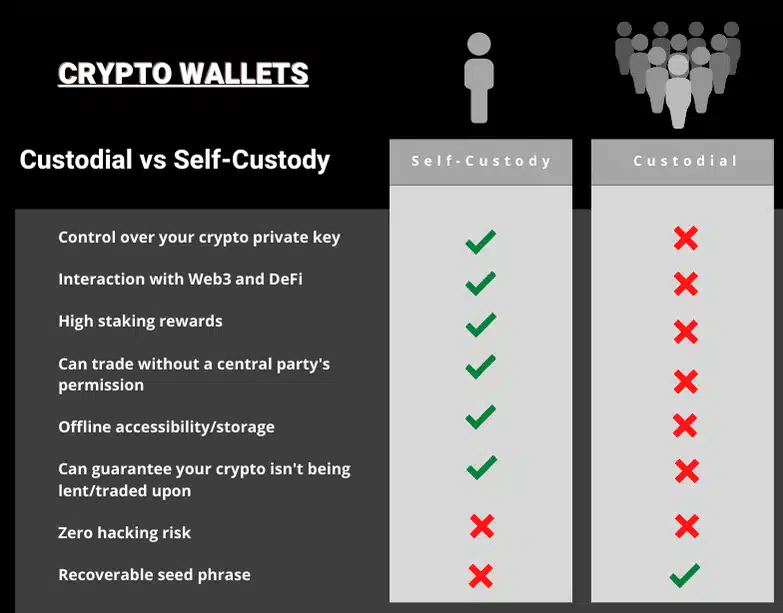

Self-custody is a foundational concept in cryptocurrency, allowing users to store their assets without relying on a centralized platform like a bank or exchange. Unlike custodial wallets, self-custodial wallets require users to be fully responsible for securing their funds as the sole custodian of their private keys.

Christian Rau, senior vice president of Mastercard’s crypto and fintech enablement, highlighted that the company’s collaboration with Mercuryo strengthens its growing commitment to self-custodial wallets.

“At Mastercard, we are working closely with partners to innovate and enhance the self-custody wallet experience,” Rau told Cointelegraph, adding:

“Through our collaboration with Mercuryo, we’re eliminating the traditional barriers between blockchain and conventional payments, providing consumers who want to spend their digital assets with an easy, reliable, and secure way to do so, anywhere Mastercard is accepted.”

Mastercard’s Push Toward Non-Custodial Wallets

Founded in 1966, Mastercard is a global payment services corporation in more than 210 countries and territories. With payments being a key use case for crypto, Mastercard’s venture into the crypto market was a natural progression.

The payment giant first announced support for cryptocurrency on its network in February 2021, acknowledging the growing importance of cryptocurrencies and stablecoins in the payments industry.

Since entering the crypto space, Mastercard has partnered with various industry players, including USDC stablecoin issuer Circle and major U.S. crypto exchange Coinbase.

Raj Dhamodharan, Mastercard’s blockchain and digital asset lead, emphasized that the company’s focus on supporting self-custody addresses the challenges associated with using centralized exchanges to buy and sell crypto.

He stated, “Many crypto hodlers try to avoid exchanges in the first place.” He further explained, “The complexities of this process have been an obstacle for both buyers and sellers as it limits both choice and the purchasing power of stored crypto.”

Mastercard’s expanding crypto and self-custody services come with associated costs. For instance, the new Mastercard-branded Spend card by Mercuryo carries a 1.6 euro ($1.8) issuance fee, a 1 euro ($1.1) monthly maintenance fee, and a 0.95% off-ramp fee imposed by Mercuryo.