The Financial Services Commission (FSC) of Mauritius initiated communication with industry stakeholders and the general public concerning incorporating the metaverse into the financial services sector.

A recent consultation document, “Reshaping the financial services sector,” revealed that the FSC Mauritius devoted the entire month of November to gathering feedback on the strategic developments and consequences of the metaverse.

Mauritius is committed to “ensuring that the regulatory and business environments in Mauritius are suitably prepared and re-engineered” in light of the ongoing global expansion of metaverse adoption.

FSC Mauritius emphasized the substantial efforts made by offshore regulators from the European Commission, the United Kingdom, Dubai, Indonesia, China, South Korea, and Singapore to accommodate the new technology with a focus on the metaverse.

“As the nations across different continents increasingly continue to take steps forward, a future can be anticipated whereby the metaverse will transform into a space that unleashes not only boundless imagination but also upholds fundamental values of consumer protection and individual empowerment.”

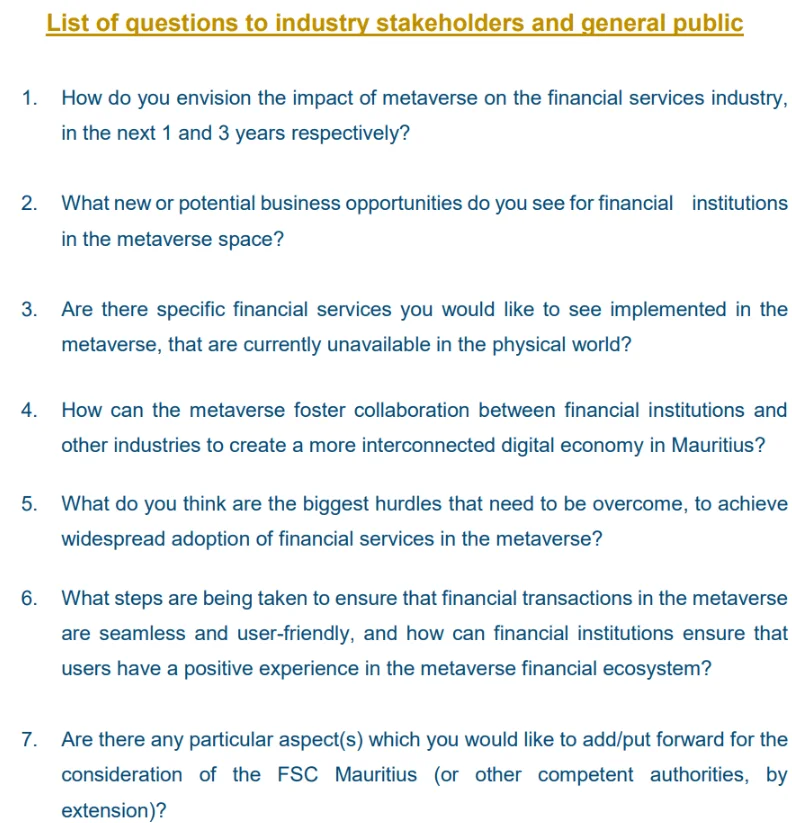

In addition to recognizing the necessity of collective effort in adapting financial services to incorporate the metaverse, the FSC Mauritius posed the following seven inquiries to the general public:

By November 30, participants must provide their viewpoints regarding the pertinent inquiries. In light of the comments and feedback, a multidisciplinary working group will be formed to address future policy and regulatory orientations concerning the metaverse in greater detail.

In November 2023, Mauritius is also anticipated to introduce the pilot phase of a digital rupee. A further official announcement, however, is forthcoming.

Harvesh Kumar Seegolam, the governor of the Bank of Mauritius, stated on April 28 that he would make CBDC development a top priority upon assuming office in 2020:

“As a central banker, I need not stress upon the determining role that CBDCs can play, not only in protecting monetary sovereignty but also in assisting central banks and regulatory authorities on the front of AML/CFT [Anti-Money Laundering/Combatting the Financing of Terrorism].”

Seegolam stated that the Bank of Mauritius “is considering” initiating a pilot program for digital rupees in November.