Metaplanet, a Japanese investment firm, buys around $7 Million in Bitcoin from a bond sale, indicating institutional interest in cryptocurrencies.

Metaplanet, a significant Japanese investment company, has expanded its Bitcoin portfolio with a recent purchase.

This action underscores the firm’s increasing confidence in Bitcoin as a critical asset and aligns with the broader trend of institutional investment in cryptocurrency.

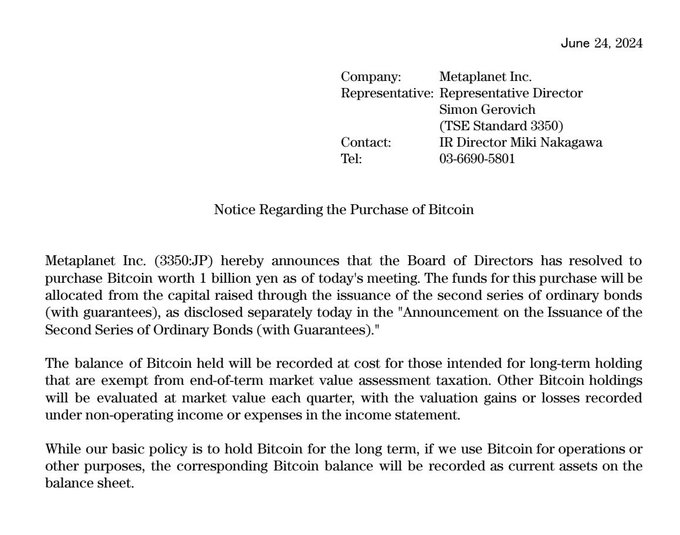

Metaplanet, known as “Asia’s MicroStrategy,” disclosed a substantial Bitcoin acquisition of ¥1 Billion ($6.25 Million) on Monday.

This purchase was supported by proceeds from a recent bond sale.

This decision reflects Metaplanet’s strategy of diversifying its investments and protecting against economic uncertainty through the use of Bitcoin.

Metaplanet’s Strategic Bitcoin Acquisition via Bond Sales

Metaplanet directors have previously authorized a significant bitcoin purchase.

On Monday, it was revealed that 1 billion yen, or around $6.25 million, would be spent on Bitcoin.

The company declared that it would utilize the proceeds from a recent bond sale to fund this purchase.

Metaplanet intends to hang onto its Bitcoin for the long term.

However, if they use it for daily operations or other purposes, they will list an equal amount as current assets on their records.

This is not Metaplanet’s first encounter with Bitcoin.

Meanwhile, they have acquired Bitcoin on three separate occasions within the last two months.

Metaplanet’s most recent buy was 23.25 Bitcoin, worth around $1.59 million, bringing their total Bitcoin hoard to 141.07 BTC.

With this most recent buy on June 24, Metaplanet’s Bitcoin holdings will increase to just over 240 BTC, worth about $15 million at current prices.

Bitcoin Market Dynamics & Metaplanet’s Hedge Plan

Metaplanet has opted to buy Bitcoin to safeguard itself from Japan’s mounting financial issues and a weaker yen.

Japan’s government owes a lot of money, and interest rates have been stuck below zero for quite some time, which is bad news for the economy.

Metaplanet hasn’t bought quite as much Bitcoin as MicroStrategy, which owns a massive 226,331 BTC, but people are still intrigued by Metaplanet’s decision to include Bitcoin in its financial holdings.

Currently, Bitcoin’s price is $62,633.31, a dip from the previous week.

The price has decreased by 2.83% over the past 24 hours, with a trading volume of $14.3 billion.

However, Bitcoin has fluctuated between $63,403.78 and $62,424.49.

Bitcoin’s overall market cap now stands at $1.2 trillion.

Despite this setback, Metaplanet’s decision to enter the crypto market appears to be a wise one.

Furthermore, they may be able to take advantage of these lower prices, which could potentially result in substantial returns in the future if the market recovers.