MicroStrategy’s (MSTR) market capitalization has surpassed $100 billion and is on course to surpass semiconductor manufacturer Intel.

According to a Nov. 19 analyst report shared with Cointelegraph, the stock is poised for additional gains as analysts anticipate that MicroStrategy’s BTC buying spree will accelerate even quicker than previously thought.

According to data from Google Finance, Intel, a semiconductor giant that has been in operation for over 60 years, has a market capitalization of roughly $102 billion as of Nov. 20.

According to research, the crypto market experienced a significant increase in response to Donald Trump’s victory in the United States presidential election, as many predict that his victory will positively impact the industry.

According to Eric Balchunas, an analyst at Bloomberg Intelligence, Microstrategy was the most traded stock in the United States on Nov. 20, surpassing major companies such as Tesla and Nvidia.

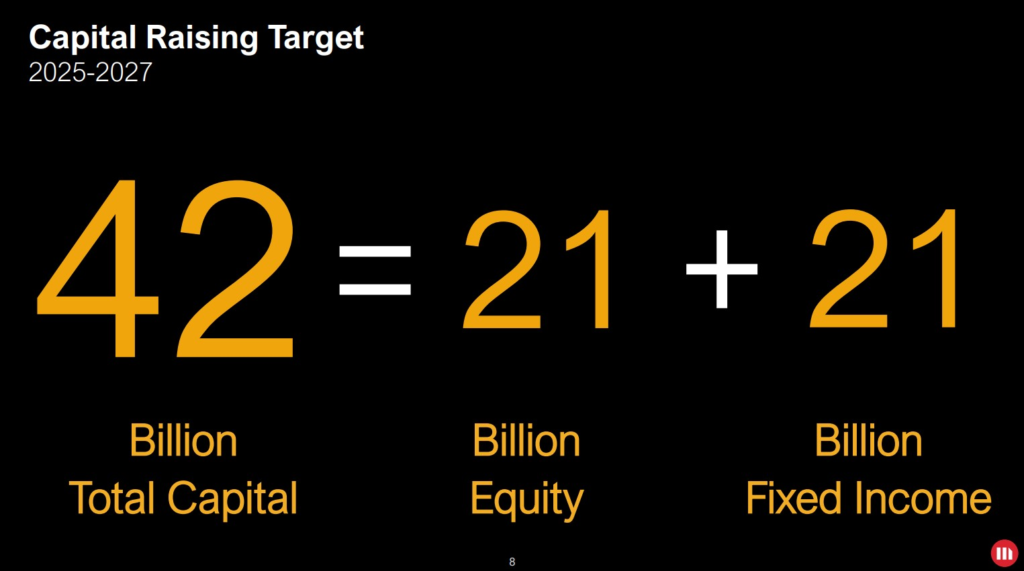

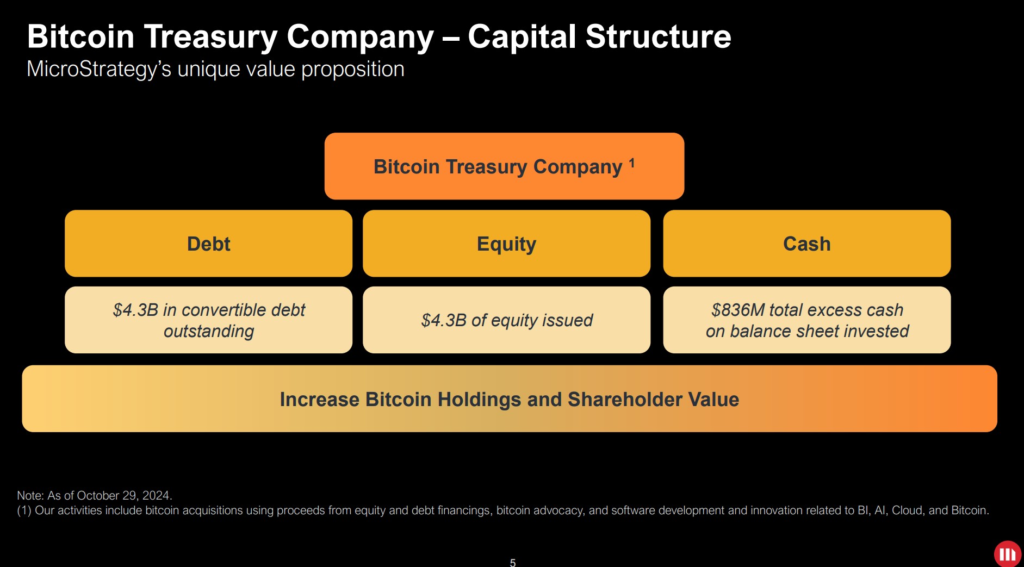

During the Oct. 30 earnings call, MicroStrategy disclosed its intention to raise $21 billion in equity and an additional $21 billion in debt to finance a three-year, multibillion-dollar BTC purchasing spree known as the “21/21 Plan.”

Mark Palmer, a fintech analyst at Benchmark, informed Cointelegraph in an email that MicroStrategy’s “controversial strategy has attracted many detractors. However, its dramatic impact on the company’s share price has provided ample justification, as its stock has outperformed almost every large company in the U.S. during the past four-plus years.”

Palmer increased his price target for MSTR to $450 per share from his previous estimate of $300 on Oct. 31. He anticipates that BTC will reach $225,000 by the conclusion of 2026.

According to Palmer, Michael Saylor, the executive chairman of MicroStrategy, stated in a CNBC interview on Nov. 15 that the company’s pace of Bitcoin acquisition and securities issuance was likely to be quicker than the original plan.

MicroStrategy announced on Nov. 19 that it had acquired 51,780 BTC for $4.6 billion between Nov. 11 and Nov. 17. This was the largest BTC acquisition in history. Benchmark estimates that it currently maintains an estimated $40 billion in Bitcoin.

In its Aug. 1 earnings call, MicroStrategy reiterated its commitment to purchasing Bitcoin by establishing a distinctive performance metric: Bitcoin yield.

The Bitcoin yield is a metric that quantifies the ratio of outstanding shares to BTC holdings, effectively establishing BTC-per-share as a benchmark for corporate performance.

Palmer stated, “Most investors have concentrated on the market capitalization of MSTR about its [net asset value]. However, we believe the BTC yield is a more valuable metric for evaluating the company’s value.”