The Bitcoin network has reached yet another all-time high in mining difficulty. This is the second time in three weeks after a steady climb since last July’s lows.

On February 18, CoinWarz, an on-chain analysis tool reported that mining difficulty had reached a new high of 27.97 trillion hashes (T). Bitcoin (BTC) has now reached a new all-time high in terms of difficulty for the second time in three weeks. When hash rates were 190.71 EH/s on Jan. 23, difficulty hit 26.7 T. (exahashes per second).

The higher the difficulty, the more miners compete to confirm a block and extract a block reward. As a result, miners have recently begun selling coins or stock in their companies to maintain their cash reserves. Marathon Digital Holdings, for example, filed on Feb. 12 to sell $750 million in company shares.

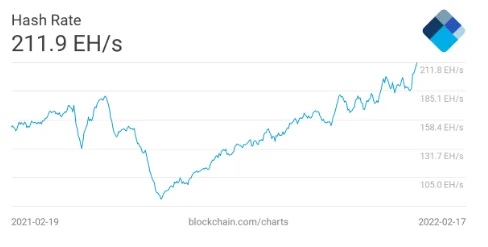

According to data from Blockchain.com, the network’s hash rate has also reached a new high, with a hash rate of 211.9 EH/s. Over the last few weeks, different monitoring methods have recorded different hash rate highs. On February 13, YCharts tools showed a hash rate ATH of 248.11 EH/s.

AntPool and F2Pool have contributed the highest hash power among the recognized worldwide mining pools. According to data from Blockchain.com, Antpool has mined 96 blocks in the last four days, while F2Pool has mined 93.

Bitcoin mining difficulty and Hashrate

Since hitting deep troughs last July, both hash rate and mining difficulty have been on the rise, regardless of the measuring techniques utilized.

According to CoinWarz, the hash rate had dropped to around 69 (EH/s at the time, and the mining difficulty had dropped to 13.6 trillion hashes (T).

However, a higher hash rate indicates the network is more secure. The more hash power the network employs, the more evenly spread the work for each on-chain transaction becomes.

This struggle between miners to secure the network while still making enough money is expected to continue as they assess the viability of their current operations.