The central banker, Neel Kashkari previously referred to cryptocurrencies as a “giant garbage dumpster”, this time Dogecoin is the target.

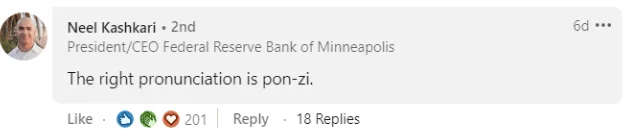

Neel Kashkari, chairman of the Federal Reserve Bank of Minneapolis, attacked Dogecoin (DOGE) last week, calling the meme coin a Ponzi scheme, adding to his comments on cryptocurrencies.

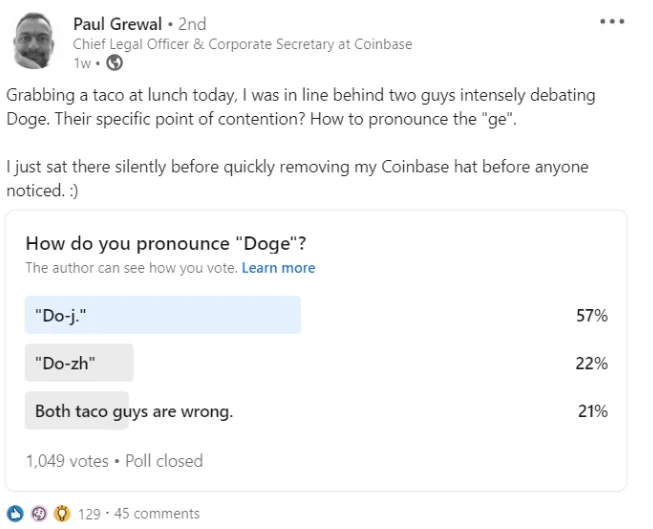

Kashkari’s comments are in response to a LinkedIn poll conducted by Coinbase’s chief legal officer and corporate secretary Paul Grewal, who asked his connections about the correct pronunciation of Doge.

“The correct pronunciation is pon-zi,” Kashkari joked.

This is not the first time Kashkari has targeted cryptocurrencies. In February 2020, he stated that digital assets such as Bitcoin (BTC) lacked basic tenants for a stable currency, and praised the United States SEC for “cracking down” initial coin offerings.

However, Kashkari is not a member of this year’s Federal Open Market Committee, the group responsible for formulating U.S. monetary policy. The Minneapolis branch of the Federal Reserve will serve as an alternate member of the FOMC in 2022, and then rotate the committee again as a voting member in 2023.

Although Kashkari did not vote on monetary policy this year, he opposed any interest rate hike before 2023. The summary of the interest rate forecast dot-matrix released by the Federal Reserve last week shows that lawmakers are considering resuming interest rate hikes before the end of 2023, which is more than It was expected earlier.

This revised forecast may have caused the U.S. dollar to rise sharply at the expense of stocks, commodities and even cryptocurrencies.

The value of digital assets fell across the board on Sunday, continuing the sharp correction of last week’s mild recovery.

Earlier this year, assets like DOGE broke into the mainstream in retail-driven FOMO, thanks to a favourable tweet from Tesla’s CEO Elon Musk. The publicity surrounding Dogecoin even surpassed Bitcoin in January, as the number of tweets soared by 1,800%.

But as the value of cryptocurrencies has plummeted, DOGE has been hit particularly hard. As Cointelegraph reported, the Dogecoin insolvency briefly outperformed Bitcoin in April.