For over a decade, about 127,000 Mt. Gox creditors owed more than $9.4 billion in Bitcoin.

Mt. Gox recently transferred billions in Bitcoin, with some of it directed toward centralized exchanges, potentially signaling further creditor repayments as the decade-long case nears its end.

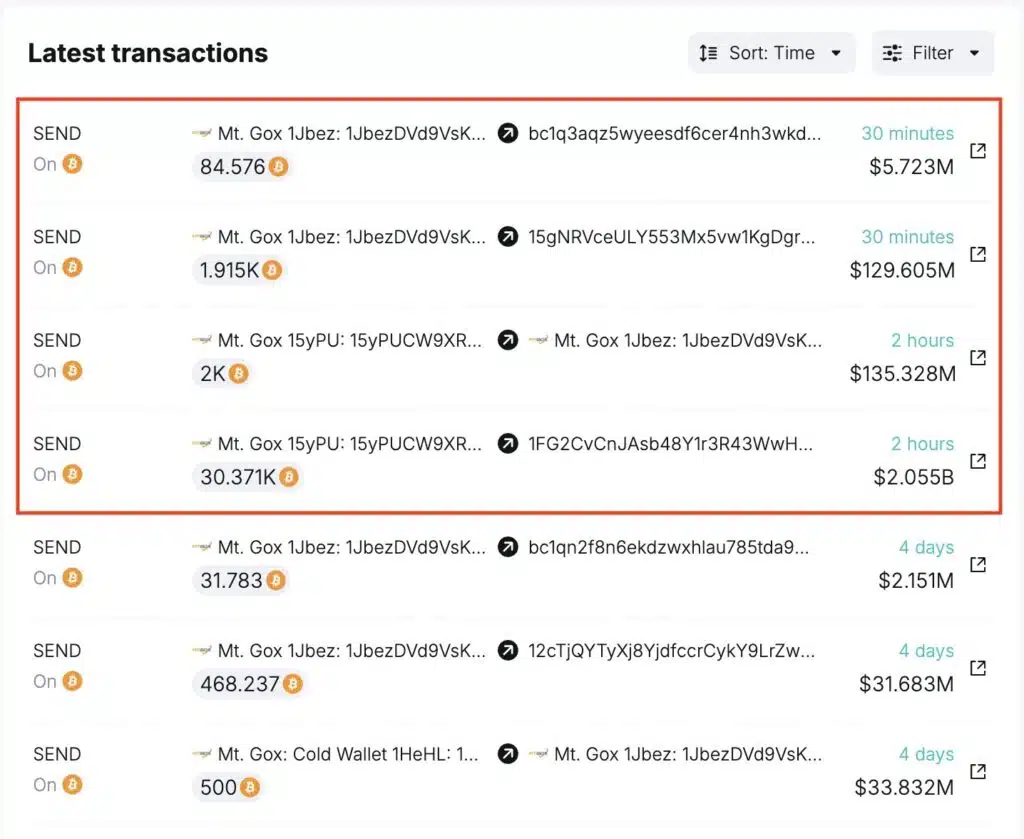

A wallet linked to the bankrupt exchange moved over $2.19 billion in Bitcoin to three separate wallets on November 4. On-chain data from Spot on Chain, shared in a November 5 post on X, reveals that some of the funds went to exchanges OKX and B2C2:

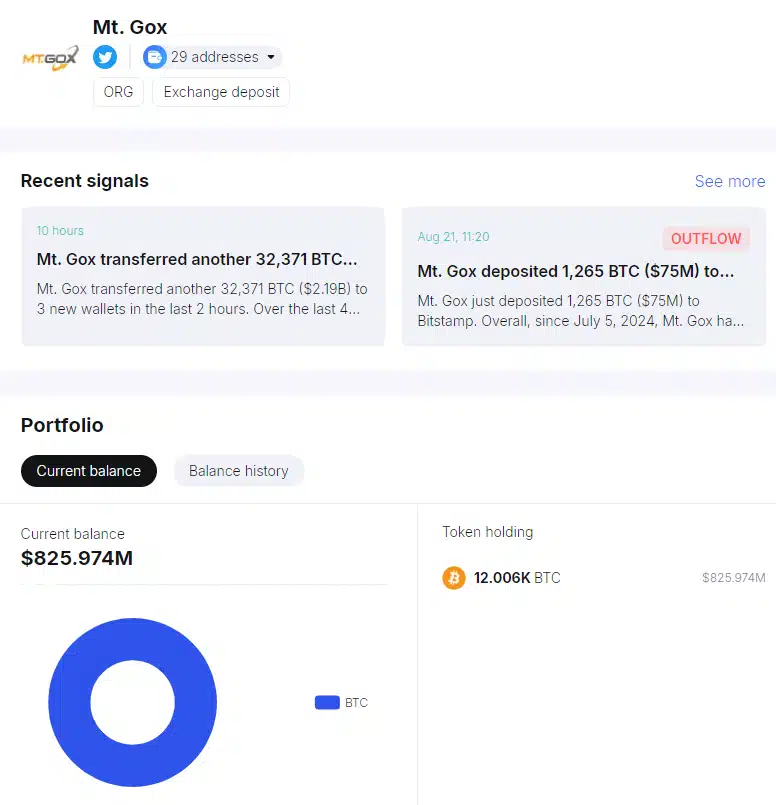

“Over the last 4 days, Mt. Gox has transferred out a total of 32,871 $BTC ($2.22B). Among these tokens, 296 $BTC ($20.13M) was moved to #B2C2 and #OKX. Currently, there remain 12,006 $BTC ($810M) in #MtGox known wallets.”

Mt. Gox had previously owed over $9.4 billion in Bitcoin to approximately 127,000 creditors, raising concerns that a surge in repayments could cause sell pressure and negatively impact Bitcoin’s price.

Potential Selling Pressure from Mt. Gox?

Currently, Mt. Gox-related wallets hold around $825 million in Bitcoin, according to Spot on Chain.

In the 10 years since Mt. Gox’s collapse, Bitcoin’s price has surged over 8,500%, heightening concerns that creditors might liquidate their holdings.

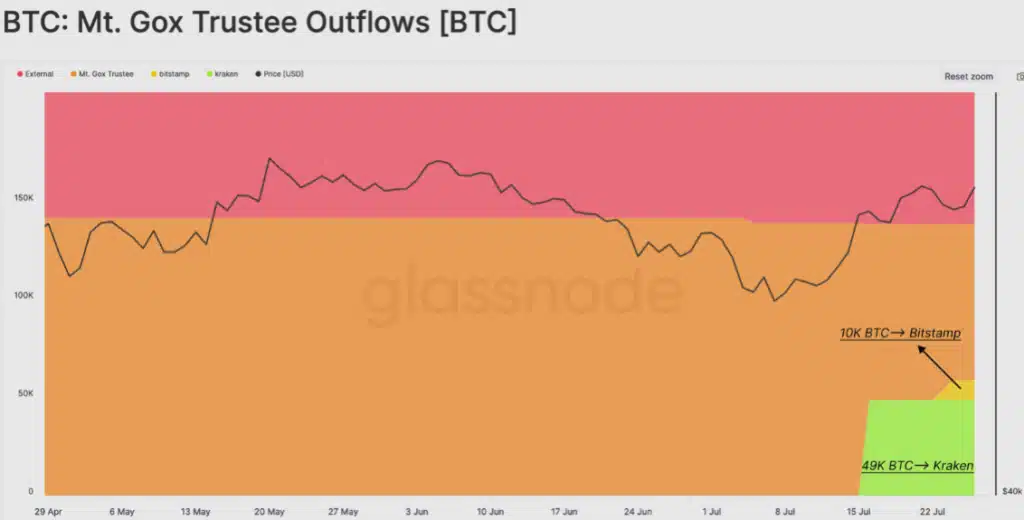

Yet, Mt. Gox creditors have largely retained their BTC. By July 30, Mt. Gox had completed 41.5% of its Bitcoin distribution, transferring 59,000 Bitcoin to creditors.

Despite receiving nearly $4 billion worth, creditors were not selling, according to a July 29 report by Glassnode:

“Creditors opted to receive BTC, rather than fiat, which was new in Japanese bankruptcy law […] As such, it is relatively likely that only a subset of these distributed coins will be truly sold onto the market.”

Once a leading Bitcoin exchange, Mt. Gox was established in Japan in 2010 and at its peak handled over 70% of Bitcoin transactions. It famously lost 850,000 BTC in a 2014 hack, making it one of the largest crypto breaches in history.