Nansen, a blockchain analytics company, reported that NFT sales volumes reached 68,342 ETH, worth over $129 million in the week ending Nov. 6.

Nansen noted in a post on X (formerly Twitter) that NFT sales totaled 29,704 ETH during the week ending October 9, equivalent to approximately $56 million at current ETH market prices. Weighing more than $129 million, the weekly sales volume ascended to 68,342 ETH.

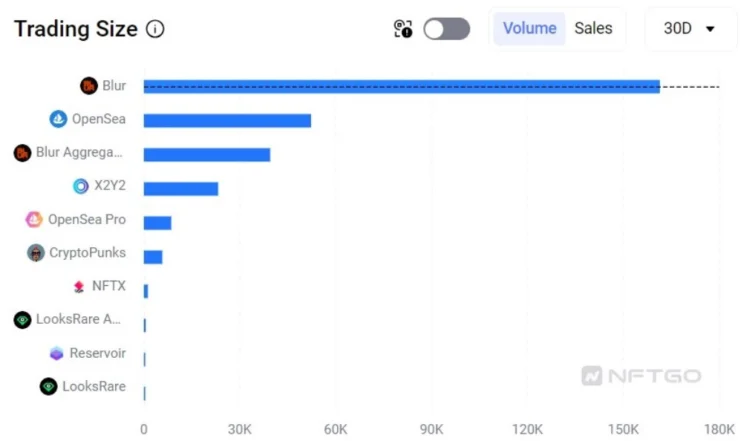

In the previous thirty days, NFT marketplace Blur held the largest share of NFT trading volume. NFTGo, a data aggregator, reports that Blur’s 30-day trading volume was 161,433 ETH (approximately $305 million).

In contrast, OpenSea, a competitor, secured the second position with a transaction volume of 52,307 ETH, equivalent to roughly $100 million.

Over the past thirty days, Bored Ape Yacht Club (BAYC) exhibited the most substantial trading volume concerning NFT collections. The volume of the BAYC collection was 35,226 ETH, or approximately $66.7 million. Mutant Ape Yacht Club (MAYC) and The Captainz followed the accumulation with 14,947 ETH and 9,948 ETH, respectively.

CryptoPunks maintained its position as the leading collection by market capitalization. In contrast, the collection’s 30-day transaction volume was 5,773 ETH.

In addition to these figures, NFTGo’s data revealed that the number of NFT traders has increased by 12% over the past week. Concurrently, the number of buyer addresses stood at 22,804, whereas the number of merchant addresses reached 27,308. In the interim, the number of wallets containing NFTs remained at approximately six million.

The increase in NFT trading volume occurred amid news that appeared harmful to the NFT market. As the NFT marketplace OpenSea prepares to release its second iteration, it laid off fifty percent of its workforce on November 3.