According to state law, the New Jersey General Assembly may contemplate a bill defining when a digital asset or “virtual currency” qualifies as a security.

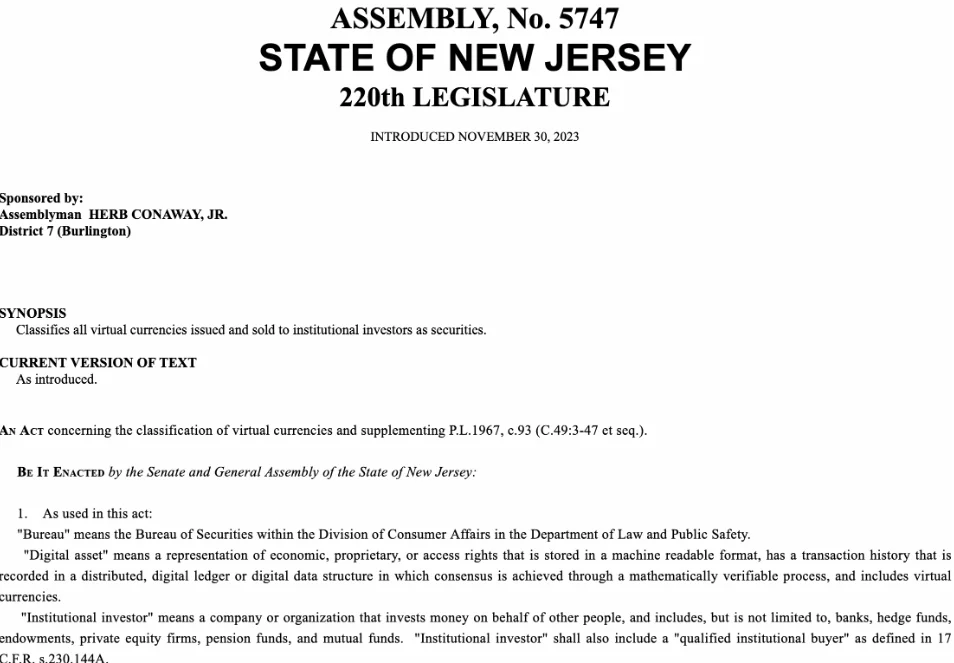

New Jersey would classify as securities all virtual currencies issued and sold to institutional investors, according to legislation introduced on November 29 by Democratic Assemblymember Herb Conaway, Jr.

According to the bill’s brief text, the legislation would supplement the New Jersey Uniform Securities Law, which now does not mention virtual or digital currency or cryptocurrency.

The legislation exclusively concerns institutional investors, defined as “organizations or corporations that make financial investments on behalf of other individuals.” It also specifies that the state’s Bureau of Securities may classify stablecoins as virtual currencies.

The legislation would be non-transactional and exempt from New Jersey law; it would not affect the federal Securities and Exchange Commission operations.

Additionally, two pending proposals in New Jersey pertain to cryptocurrencies. The Virtual Currency and Blockchain Regulation Act would govern decentralized autonomous organizations and consumer digital assets. Pending the governor’s signature, it passed both branches of the New Jersey legislature.

Furthermore, state-approved businesses “required to operate in cash-only or cash-heavy environments” and lack access to traditional financial services would be required by the Digital Asset and Blockchain Technology Act for the state Department of Treasury to assess and authorize a digital payment platform.

Implementing a virtual currency pegged to the U.S. dollar, the platform would streamline municipal tax payments, audits, and compliance.