The Central Bank of New Zealand is deliberating on issuing a central bank digital currency (CBDC) and aims to issue an in-house digital dollar by 2023.

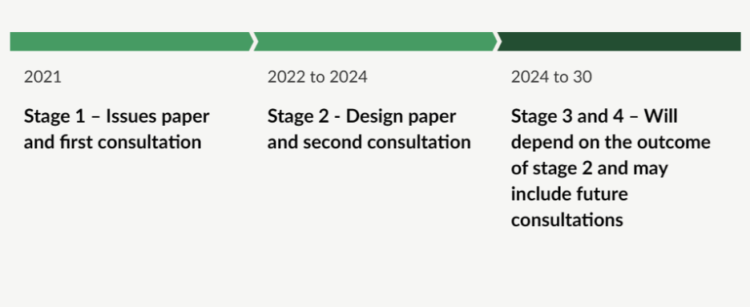

The issuance of CBDCs is a four-step process for the Reserve Bank of New Zealand (RBNZ), which plans to introduce an internal digital currency by 2023.

Exploring high-level design options for digital currency and conducting the necessary consulting and budgeting are components of the second phase of the digital cash initiative at the Central Bank of New Zealand.

The central bank issued a consultation paper on April 17 to determine “future work on whether digital cash is suitable for New Zealand.” The deadline to submit a consultation is July 26.

The consultation paper emphasizes the importance of aligning with other central banks and the declining use of currency while promoting CBDC adoption.

“Cash is no longer a core payment medium for many people. The frequency of cash use by New Zealanders continues to fall.”

Twelve questions on four main subjects comprise the consultation paper: individual sentiments regarding the CBDC of New Zealand, the advantages of digital currency, strategic design, and managed issuance. Launching a CBDC alongside a comprehensive supporting infrastructure, according to RBNZ, can stimulate innovation in the local payments sector.

Simultaneously, the Reserve Bank of New Zealand (RBNZ) is altering its digital cash consultation document format, anticipating its release in late May.

The minister of consumer affairs and commerce of New Zealand, Andrew Bayly, recently cautioned against the nation’s sluggishness in adopting and experimenting with blockchain technology and digital assets.

Bayly’s office issued the following statement in response to the Parliamentary Finance and Expenditure Committee’s inquiries regarding cryptocurrencies:

“The current ‘wait and see’ approach could risk New Zealand missing out on the benefits of development in the digital asset industry.”

For New Zealand to regain prominence in the global cryptocurrency community, the ministry’s advisers put forth eight essential suggestions. These encompass the implementation of policies and regulations that foster advancements in blockchain technology and digital assets and enhance collaboration between the government and industry stakeholders.