Nexo Pro will collect liquidity from different market makers to try to give its users the least amount of slippage possible.

A press release shared with correspondence says that Nexo, a company that lends out cryptocurrency, has made a trading platform available to retail clients that lets them trade spot, futures, and margin.

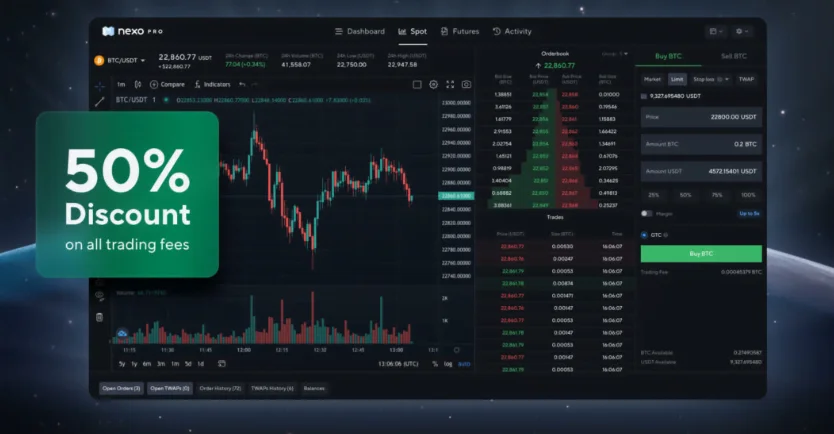

Nexo Pro is the name of the trading platform that will bring together liquidity from more than 10 trading venues and market makers to reduce order slippage, which is the change in price that happens between when an order is placed and when it is executed. Slippage happens when a market order is made when there isn’t enough stock on the market, which makes the average price change.

Nexo has been able to make it through this year’s “crypto winter.” This is something that many of Nexo’s competitors, like Voyager Digital and Celsius Network, have not been able to do. Both of these companies have filed for bankruptcy in the past few months due to the sharp drop in cryptocurrency prices.

Nexo’s lending platform already had a “swap” feature that let users trade one cryptocurrency for another. However, this is the first time a company like Nexo has moved into derivatives trading.

Trading platforms and exchanges do not, however, have no risks. Last month, the New York financial services company Eqonex shut down its exchange product, citing high market competition, low margins, and a lot of technology work. Coinbase (COIN) has also stopped selling Coinbase Pro as a separate product in order to add “advanced trading” to its regular app.

Kosta Kantchev, the co-founder and executive chairman of Nexo, is still confident. In the statement, he called Nexo Pro “a gateway for retail customers to trade like professionals.”

“We are the first platform to offer institutional-grade liquidity aggregation with this many venues, as pure-play exchanges usually prefer to settle only within their own order books,” he said.