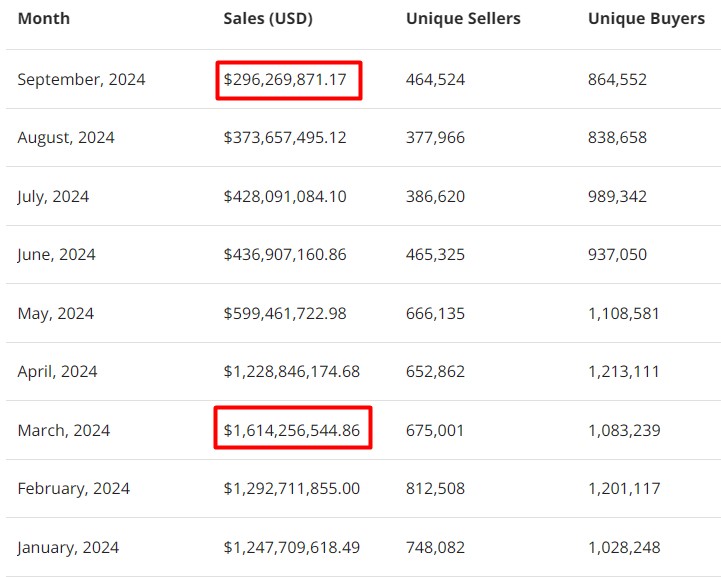

NFT sales in September dropped to $296 million, down 20% from August and 81% from March’s $1.6 billion peak.

Non-fungible token (NFT) sales resumed their downward trajectory in September, as digital collectibles’ monthly sales volumes failed to recover. The sales volume of non-fungible tokens in September was $296 million, according to data provided by CryptoSlam.

This is a 20% decline from the sales volume of $373 million reported in August. Compared to the sales volume of $1.6 billion in March, the peak month for digital collectibles in 2024, this result signifies an 81% decrease.

Since January 2021, when the monthly sales volume dropped to $109 million, the digital collectibles industry has not seen a monthly sales volume of less than $300 million.

In addition to the volume of sales, the overall number of Non-fungible token transactions had a 32% decrease, going from 7.3 million in August to 4.9 million in September. The average value of Non-fungible token transactions climbed by 18% from $50.71 in August to $60 in September, despite the fact that there were many unfavorable data points in the NFT area for the month of September.

United States regulator eyes NFTs

The United States Securities and Exchange Commission (SEC) has turned its attention to non-financial instruments , which has resulted in a decreasing trend within the NFTs industry. Devin Finzer, the CEO of the Non-fungible token marketplace OpenSea, reported on August 28 that the company had received a Wells notice from the securities regulator over its operations.

According to Finzer, the Securities and Exchange Commission (SEC) has suggested that the non-financial instruments on the platform can be considered unregistered securities. The SEC fined Flyfish Club, a restaurant with a Non-fungible token motif, $750,000 on September 16 for selling NFTs.

SEC commissioners Hester Peirce and Mark Uyeda expressed their disapproval of their agency’s enforcement action, arguing that Flyfish’s non-financial instruments (NFTs) should not fall under securities laws. “A different way to sell memberships,” the commissioners stated, referring to these non-profit organizations.

In spite of the SEC’s crackdown on non-fungible tokens (NFTs), Luca Schnetzler, the chief executive officer of the well-known Non-fungible token collection Pudgy Penguins, referred to the activities of the regulator as “nonsense”.

Schnetzler described the actions of the Securities and Exchange Commission (SEC) as insignificant. He argued that the SEC must also take action against larger corporations that have invested in non-financial transactions (NFTs) in order to pursue OpenSea. Included in this category are Sotheby’s, Nike and Pokemon.