The weekly sales volumes of non-fungible tokens (NFTs) have reached their most outstanding level since August, following weeks of lagging sales and a downward market trend.

CryptoSlam!, an NFT market tracker, reports that weekly transactions peaked at more than $84.9 million from September 30 to October 6.

It is the most significant weekly volume of NFT sales since August 25, when it exceeded $93 million.

According to CryptoSlam!, the weekly sales volume for NFTs peaked at more than $2.2 billion from August 23 to August 29, 2021.

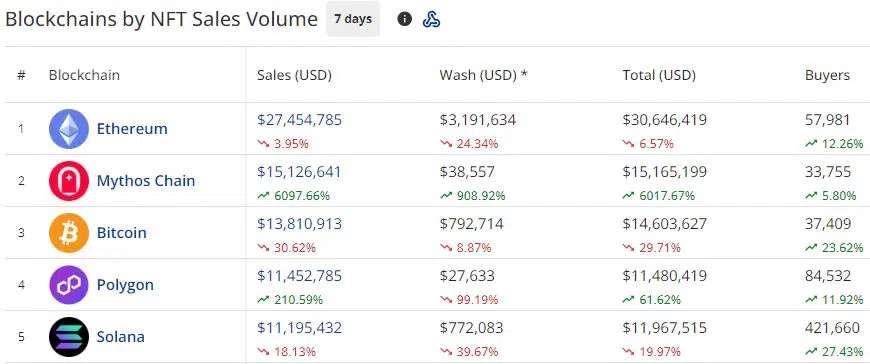

Simultaneously, the trading volumes of three of the top five blockchains for NFTs decreased compared to the previous week, including Bitcoin, Ether, and Solana.

Mythos Chain achieved the most significant increase in gains, soaring to second place overall under Ethereum with over $15 million in sales, a 6,000% increase in the past seven days.

Polygon also experienced a 210% increase in weekly sales volume, contributing to its positive performance.

Dmarket’s NFT collection was the most successful in the past seven days, with over $14 million in sales across 537,714 transactions.

Aside from the rise in total weekly volume, the number of NFT buyers has also increased. CryptoSlam data indicates that over 839,000 NFT buyers have purchased NFTs in the past seven days, a nearly 22% increase from the previous week.

Additionally, there was a substantial increase in transactions, with over two million instances recorded, representing a 71% increase from the previous week.

The broader NFT market continues to face significant challenges in regaining the momentum and achieving the highs of previous years.

According to data from CryptoSlam!, the overall transactions of NFTs in September were $303 million, representing a decrease from $373 million in August.

March has been the market’s most successful month in 2024, with a sales volume of $1.6 billion.

NFT Evening analysts reported on August 20 that 96% of the approximately 5,000 NFT collections they analyzed no longer exist in 2024, with more than one-third expiring in 2023.

The report indicates that none of the collections under examination had experienced any trading activity, sales, or social media engagement for a period exceeding one week. It was also determined that the average tenure of NFT collections was just over one year.