Kraken and BitMEX topped the proof-of-reserves score list, while Binance received a low score for being incomplete.

Bitcoin advocate Nic Carter has ranked the attestations supplied by some of the most well-known crypto trading platforms and published an in-depth review of centralized exchange proof-of-reserves.

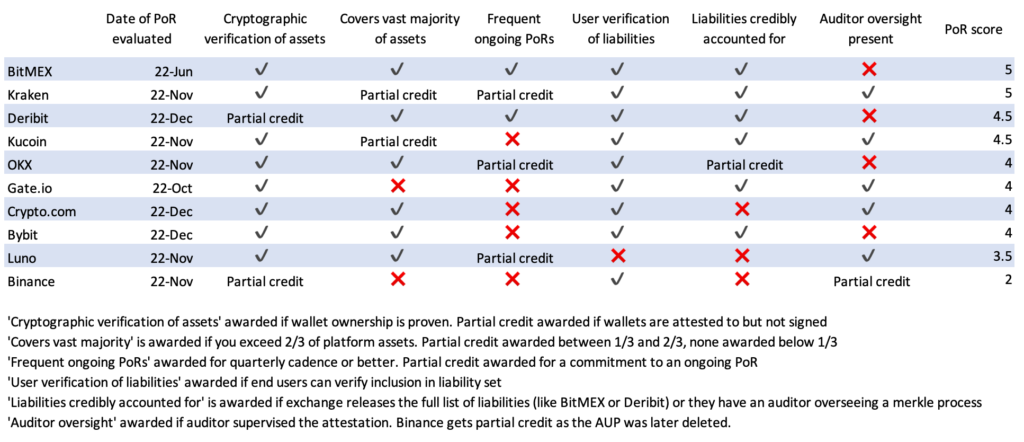

Carter published a thorough analysis of the proof-of-reserves from various exchanges. The cryptocurrency executive employed criteria including attestation to assets held and a declaration of liabilities, incorporation of a third-party auditor, establishing credibility by taking a PoR for all assets, and commitment to a continuous process to identify which PoRs are of the highest quality.

The top two cryptocurrency trading platforms were BitMEX and Kraken. Carter claims that Kraken, which used Armanino for its proof-of-reserves, provides clients with a “good level of assurance” that no hidden liabilities exist.

Carter also commended the trading platform for sticking to its promise to conduct PoRs every six months. However, BitMEX, which also earned plaudits, opted for a model that was extremely transparent rather than relying on an auditor.

Regarding assets, the exchange provided a list of all BTC amounts it currently possessed along with evidence that the BitMEX multisig can be used to spend them.

The company released the complete Merkle tree of user balances together with its obligations. Since anyone can verify the responsibility set in its whole, there are no problems with excluded or negative amounts, Carter noted.

While several cryptocurrency exchanges’ PoR scores were highly regarded, Binance’s PoR scored poorly in the rankings. Carter asserts that the exchange’s poor PoR score is due to the PoR’s deficiencies.

Despite Binance CEO Changpeng Zhao (CZ) underlining the significance of PoRs following the FTX collapse, the analyst for cryptocurrencies thinks the executive “hasn’t yet risen to his own challenge.” He stated:

“Binance’s first PoR doesn’t grant strong assurances. It only covers Bitcoin, which only represents 16.5% of their client assets.”

Despite the fact that the PoR enables individual users to confirm their inclusion in the responsibility set, according to Carter, the PoR does not display the whole liability list. According to the expert, this makes it difficult for a third party to verify the technique.