The Central Bank of Nigeria has lifted its ban on crypto transactions and issued new guidelines for banks to manage their relationship with crypto service providers. The move follows the global trend of crypto regulation and compliance.

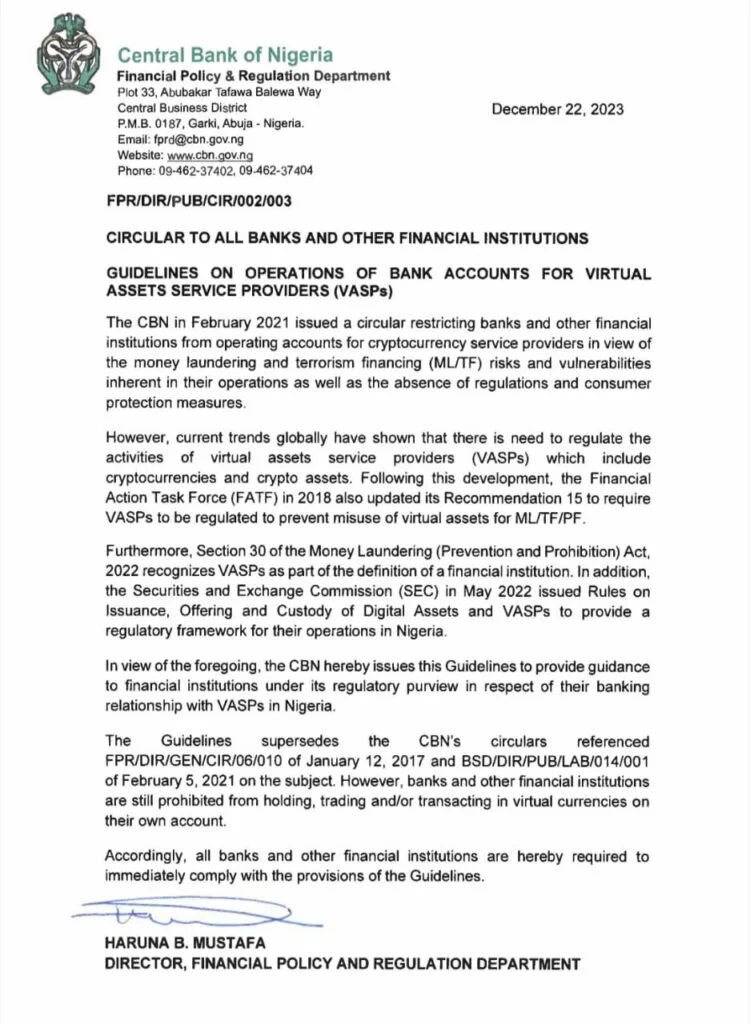

The apex bank has changed its position on crypto assets in the country and instructed banks to disregard its previous prohibition on crypto transactions. The CBN announced this in a December 22, 2023, circular signed by its Director of Financial Policy and Regulation, Haruna Mustafa.

The circular, titled ‘Circular to all Banks and other Financial Institutions Guidelines on Operations of Bank Accounts for Virtual Assets Service Providers (VASPs),’ stated that the CBN has recognized the need to regulate the activities of crypto service providers, in line with the global trend and the recommendations of the Financial Action Task Force (FATF).

The CBN said that it had earlier banned banks and other financial institutions from operating accounts for crypto service providers in February 2021 due to the money laundering and terrorism financing (ML/TF) risks and vulnerabilities inherent in their operations, as well as the lack of regulations and consumer protection measures.

However, the CBN said that it has now issued new guidelines to guide financial institutions under its regulatory purview with respect to their banking relationship with crypto service providers in Nigeria. The CBN also cited the Money Laundering (Prevention and Prohibition) Act, 2022, which recognizes crypto service providers as part of the definition of a financial institution, and the Securities and Exchange Commission’s Rules on Issuance, Offering, and Custody of Digital Assets and VASPs, which provide a regulatory framework for their operations in Nigeria.

Nigeria’s Central Bank Sets New Rules for Banks and Crypto Service Providers

The circular also noted that the new guidelines supersede the old ones referenced FPR/DIR/GEN/CIR/06/010 of January 12, 2017, and BSD/DIR/PUB/LAB/014/001 of February 5, 2021, on the subject. The circular also affirmed that banks and other financial institutions are still prohibited from holding, trading, and/or transacting in virtual currencies on their own account.

The new guidelines require banks and other financial institutions to conduct due diligence on crypto service providers before opening accounts for them, and to monitor their transactions and report any suspicious activities to the relevant authorities. The guidelines also require banks and other financial institutions to obtain approval from the CBN before providing any services to crypto service providers and to comply with the FATF standards and recommendations on crypto assets.

The circular added that all banks and other financial institutions are required to immediately comply with the new guidelines and that any breach of the guidelines will attract sanctions from the CBN.

Nigeria’s Central Bank Follows the Global Trend of Crypto Regulation

The CBN’s reversal of its crypto ban and its adoption of new guidelines for banks and crypto service providers are significant developments for the crypto industry in Nigeria, and they follow the global trend of crypto regulation and compliance.

According to the FATF, crypto service providers are entities that conduct one or more of the following activities or operations for or on behalf of another natural or legal person:

- Exchange between virtual assets and fiat currencies

- Exchange between one or more forms of virtual assets

- Transfer of virtual assets

- Safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets

- Participation in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset

The FATF has updated its Recommendation 15 in 2018 to require crypto service providers to be regulated to prevent the misuse of virtual assets for ML/TF/PF and to apply the same preventive measures as other financial institutions, such as customer due diligence, record-keeping, reporting, and supervision.

The CBN’s new guidelines for banks and crypto service providers are in line with the FATF’s standards and recommendations and aim to enhance the transparency, accountability, and security of the crypto industry in Nigeria. The new guidelines could also boost the adoption and innovation of crypto assets in Nigeria, as they provide a clear and consistent regulatory framework for the sector.