Due to the Normie smart contract exploit, a memecoin trader has suffered a financial loss exceeding $1 million in digital assets.

According to a May 26 X post by Lookonchain, the memecoin merchant spent over $1.16 million to acquire 11.23 million Normie (NORMIE) memecoins, but his initial investment dropped by over 99% to $150.

“He spent $1.16M to buy 11.23M $NORMIE at $0.1035 from Mar 25 to Apr 9 and has held it until now without selling it.”

A smart contract vulnerability affecting the Base-native memecoin Normie washed out over $41.7 million from the token’s market capitalization in less than three hours. On May 26, Lookonchain was the first to identify the vulnerability in an X post.

As per CoinGecko data, Normie’s market capitalization peaked around $200,000 after the exploit, when its value plummeted by more than 96%, before beginning a modest recovery.

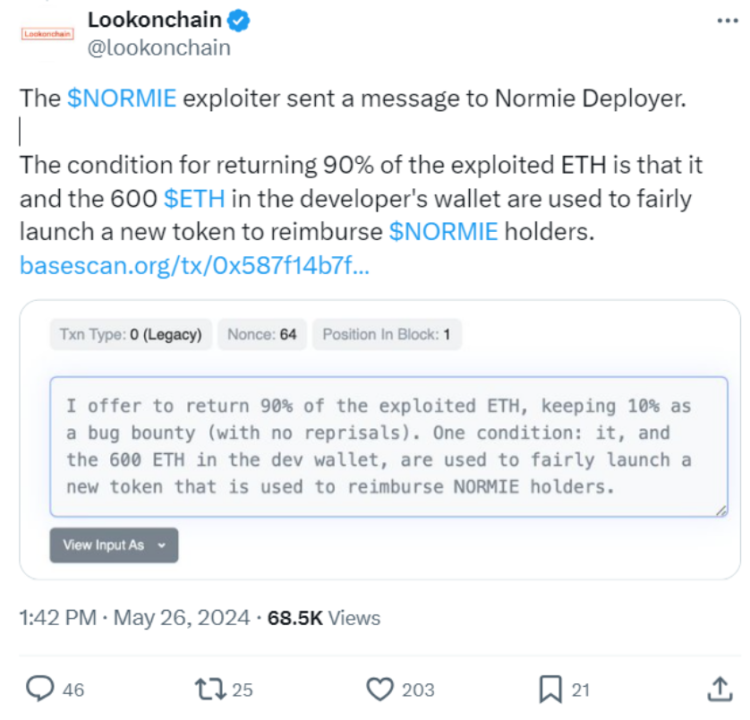

The Normie team purportedly accepted the hacker’s offer to return 90% of the stolen NORMIE tokens on May 27. This agreement required Normie to introduce a new token to reimburse NORMIE holders using the returned funds and an additional $2.3 million from the team’s development wallet.

Lookonchain obtained a blockchain message from the exploiter indicating that the hacker demanded that the token launch occur before the stolen funds were returned.

“During this exploit, the developer wallet generated a substantial surplus compared to my earnings; without recourse, I am compelled to ensure that those funds are utilized responsibly.”

“The dev wallet made significantly more than I did during this exploit, and I have no other way to ensure that those funds are used appropriately.”

X experienced a deluge of fraudulent Normie posts after the hacker’s proposition, which purported to declare the reintroduction of the new token. The purpose of these posts was to entice individuals to click on fraudulent hyperlinks.

In March, an on-chain analytics firm, Quick Intel, disclosed in a May 26 X post that the smart contract exploit impacted more than 72,000 Normie holders.