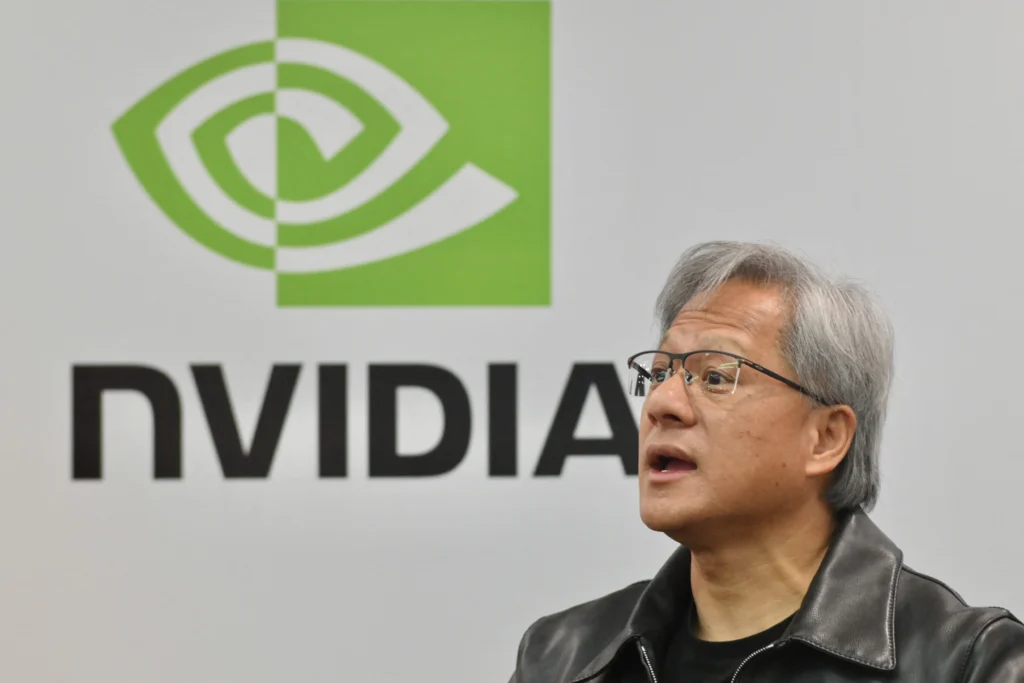

Nvidia CEO Jensen Huang sold $49M in shares amid a recent market gain and strategic timing.

Jensen Huang, the CEO of Nvidia, recently sold $49 million in NVDA shares, which has garnered market attention along with his recent disposal.

Huang’s strategy is derived from a plan that he submitted in March, which enabled him to anticipate the broader stock market decline that occurred last week. The stock of NVDA has increased by 13% this week, trading at $104.74, as a result of the strengthening of macroeconomic factors.

Nvidia CEO Extends Stock Offload

Jensen Huang recently liquidated 470,000 shares of NVDA stock, which were valued at approximately $49 million, from his portfolio.

The most recent activities indicate that Huang has sold over $500 million in shares in the past two months, with $49 million recorded this week. He sold $322.7 million of NVDA in July, surpassing the stock sell-off.

This year, the artificial intelligence (AI) semiconductor manufacturer garnered trader attention after experiencing substantial gains, temporarily surpassing Apple and Microsoft. Nevertheless, the CEO of the company continues to divest assets from his portfolio as it faces increasing pressure.

The firm’s corporate earnings are the subject of significant pressure from investors who are skeptical of the impact of AI expenditure. In the midst of the AI-inspired rally, Huang’s recent disposal is not an isolated event; the company’s insiders have sold over $1 billion worth of shares this year.

According to a recent filing, the CEO intends to conduct additional stock sales this month. The price of NVDA closed at $104.75 on Friday, representing a 0.21% decrease.

The asset experienced a 13.8% increase this week, marking a recovery from the previous stock decline. Nevertheless, the asset experienced a 22.36% decline over the past 30 days.

AI Drives NVDA Forecasts

Numerous analysts anticipate that Nvidia’s second-quarter earnings will surpass those of the previous year. In order to provide context, the company has reported better-than-expected results since Q2 2023, despite the fact that recent monthly figures have decreased, as AI continues to dominate narratives.

Meta, Amazon, Microsoft, and other customers of the semiconductor manufacturer intend to enhance their AI infrastructure, as reported by Bloomberg.

Nevertheless, the recent Q2 earnings of Amazon and Intel, as well as the recent U.S. employment data, have caused some investors to express a mild skepticism, as evidenced by the stock swing from last week.