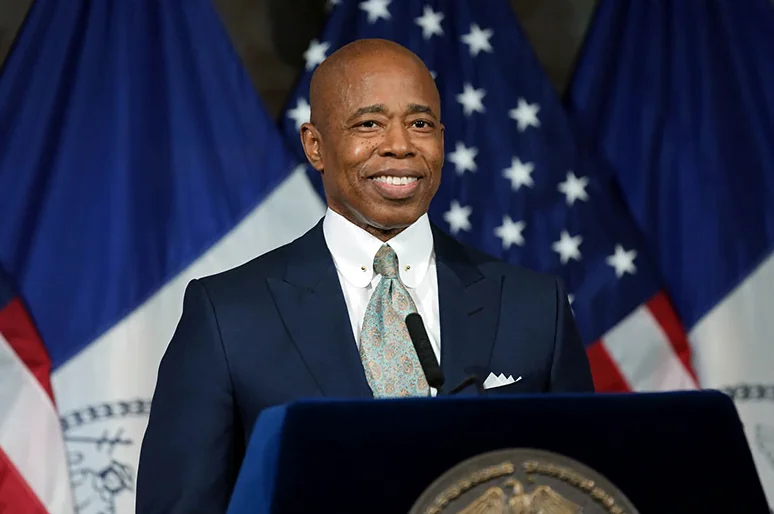

Despite a decline in the value of several tokens in 2022, New York City’s new mayor, Eric Adams, is apparently sticking to his promise of making the city a crypto-friendly one.

Adams reportedly said on December 12 that he still wants New York City to be the “heart of the bitcoin sector,” which was one of his goals while running for mayor in November 2021.

According to reports, the New York City mayor changed his first of three salaries while in office into Bitcoin and Ether in January and February, before the collapse of the cryptocurrency market.

According to Jonah Allon, a press secretary for Adams, “Mayor Adams thinks cryptocurrencies, blockchain, and other new technologies provide an enormous potential for innovation and economic development over the long term, and he wants to see that happen right here in New York.”

Price fluctuations are a normal part of the market for financial goods, and it is naive to think that a sector’s setbacks would prevent it from seeing long-term progress.

Based on the price of BTC and ETH, Slate’s projections revealed that Adams may have lost up to 60% of his cryptocurrency investment, assuming he held onto those assets.

The price of BTC was $16,998 at the time of publishing, having decreased by more than 66% in the preceding 12 months, while the cost of ETH was $1,249, having decreased by around 70% in the same time frame.

The state of New York enacted a measure that would put a two-year embargo on proof-of-work mining during Adams’ term in office.

The price of the NewYorkCityCoin (NYCCoin) project, which was introduced in November 2021 with the backing of the mayor-elect at the time, has likewise dropped by more than 93% over the last 12 months, coming to around $0.0003 at the time of writing.

The failure of the cryptocurrency exchange FTX also seems to have prompted state authorities and politicians to take action, as New York Attorney General Letitia James has suggested that retirement funds be barred from accepting cryptocurrency investments.

Ritchie Torres, a representative representing New York, wrote a letter to the U.S. Government Accountability Office on December 6 demanding that an investigation looks into the Securities and Exchange Commission’s handling of FTX.