The New York Department of Financial Services (DFS) has reportedly granted regulatory approval to stablecoin issuer Paxos to launch its products on the Solana blockchain.

Currently, only the Ethereum network has authorized the company to issue its Pax Dollar (USDP) stablecoin due to limitations imposed by the DFS. The anticipated premiere date for Paxos on Solana is January 17, 2024.

The Pax Dollar is a fiat-collateralized stablecoin, meaning the United States dollar provides one-to-one backing.

According to Fortune, following an “extensive and exhaustive review,” Paxos obtained a “non-objection” regarding the expansion of USDP from Ethereum to Solana, according to Paxos’ chief of strategy, Walter Hessert. The evaluation centered on Solana’s internal risk framework.

Hessert asserts that Paxos is “the most regulated stablecoin issuer in the world,” alluding to the firm’s rivals Tether USDT and USD Coin, which are not subject to regulation by DFS. He emphasized, “We are the only company that has issued regulated stablecoins on a large scale—period.”

According to Hessert, Solana’s comparatively lower costs and quicker transaction speeds may render it a more attractive option for Paxos’ counterparties. Furthermore, he proposes that PayPal consider extending its stablecoin PayPal USD PYUSD to Solana.

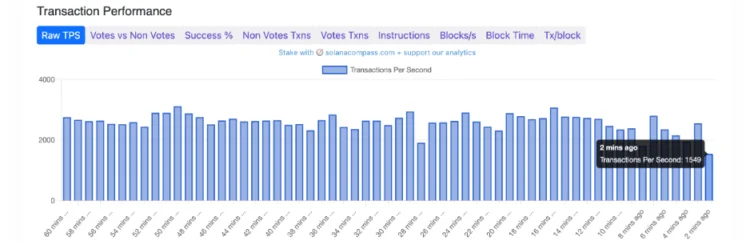

Low-cost and high-transaction-speed Solana is a layer-1 protocol. It can process between 50,000 and 65,000 transactions per second (TPS), significantly faster than Ethereum’s current capacity of 30 TPS. Numerous disruptions plagued the protocol in 2022, but it has been operational 100% for the past few months.

The head of strategy at Paxos says it is pursuing regulatory sanction for additional layer-1 and layer-2 blockchains. In recent months, Paxos has undertaken an expansion of its global operations.

The company disclosed a preliminary sanction from Singapore’s regulator for a new entity aiming to introduce a stablecoin backed by the U.S. dollar on November 16. Abu Dhabi’s regulator also authorized Paxos to issue stablecoins and provide digital asset services within the emirate.