OKX has received an MPI license in Singapore, allowing it to offer cryptocurrency trading and cross-border transfers without volume limits.

Having obtained a complete license in Singapore, the cryptocurrency exchange OKX is now able to offer cryptocurrency trading as well as transfers across international borders.

The company also announced that it had hired a former regulator to serve as the chief executive officer of its subsidiary, OKX Singapore. The Monetary Authority of Singapore (MAS) reported on September 2 that the exchange had received its Major Payment Institution (MPI) license.

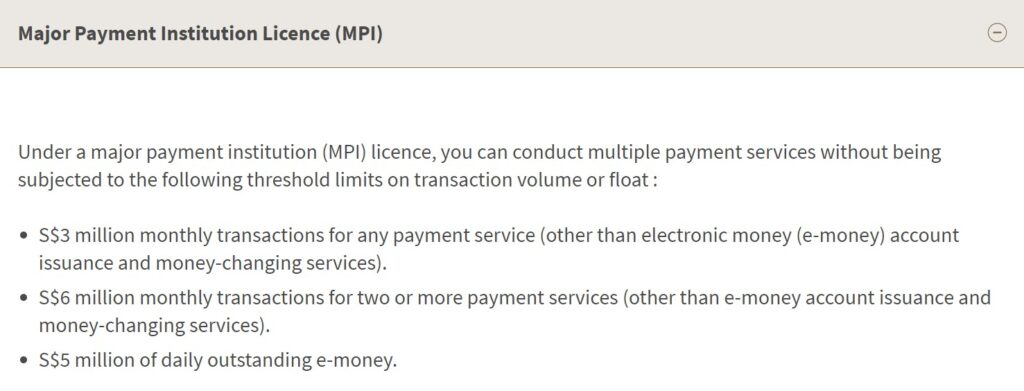

This license allows the exchange to provide international money transfers as well as digital payment tokens. OKX is now able to surpass the volume constraints that payment institutions have with its newly acquired license.

It is possible for licensed businesses to exceed the volume limit of three million Singaporean dollars, which is equivalent to two and a half million dollars.

Furthermore, the exchange will receive permission to exceed the monthly limit of 6 million Singapore dollars ($4.4 million) for the use of two or more payment services.

In addition to the license, OKX Singapore announced that it has appointed Gracie Lin, who had previously worked at MAS in a variety of capacities, to the position of chief executive officer.

In a post, Lin stated that Singapore is an essential component of the exchange’s worldwide strategy because it is a vital center for both digital assets and cryptocurrency.

“Obtaining the license is an important step in our journey, and we are more committed than ever to enabling access for our customers and contributing to the community and ecosystem.”

According to Lin, the recently obtained MPI license would enable the company to provide services like cross-border money transfers and digital payment tokens, as well as spot trading of cryptocurrencies in Singapore.

Lin claimed that this will be possible. Henley & Partners, an investment migration consultancy organization, conducted a study that revealed Singapore as the global leader in cryptocurrency adoption.

Using adoption, infrastructure, legislation, economic factors, and tax friendliness as criteria, the research evaluated several jurisdictions in order of importance. With a total score of 45.7 out of 60 points, Singapore achieved the greatest overall score.

As a result of the country’s financial, business, and regulatory framework, the study found that the country is at the forefront of cryptocurrency adoption. The nation received particularly high marks in the areas of economic issues and technology.

Hong Kong, which is a special administrative area of China, came in second place on the list, followed by the United Arab Emirates. Both nations excelled in terms of their tax-friendly policies and procedures.